AT&T (NYSE:T) shares have declined nearly 24% this year amid higher debt levels and the impact of the Coronavirus pandemic. But that also means the company's dividend yield is now around 7%. Using the covered call strategy below, one could boost a total income yield on AT&T stock to almost 14% if the stock continues to move sideways.

Boost The Yield With Covered Calls

Covered calls can be a great way to collect some extra premium without taking any additional downside risk (one could argue there is lost opportunity risk associated with capping one's upside in a stock with a covered call). AT&T already pays a 7% yield. This can be boosted to 14% with the following relatively simple covered call strategy.

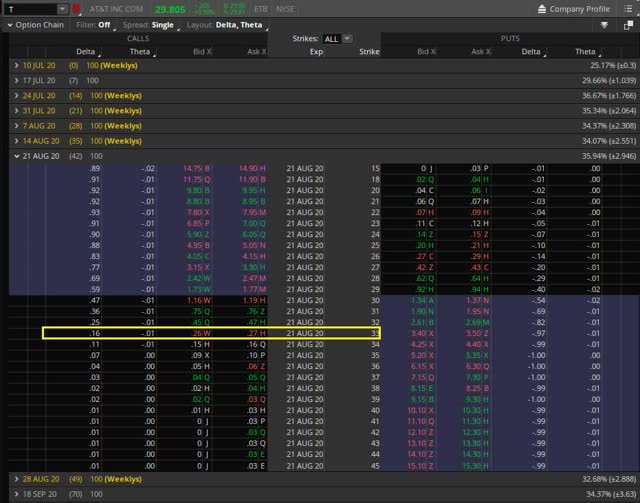

The options chain for the August 21 expiration, 42 days out as of the time of writing, at around mid-day on Friday, July 10, 2020, is displayed below.

Source: Thinkorswim

Taking a look at the calls (left side of the image), one can see numerous calls, all of which are highly liquid with most of the OTM calls offering a one cent spread. This is important on a stock like AT&T as the share price is on the lower end and slippage could have a substantial impact on this strategy in a less liquid stock. Fortunately, this is not something to worry about on AT&T.

I tend to gravitate toward 15 delta options when looking at a covered call strategy. I find this often gives a solid balance of premium collected while still leaving some room to the upside on the stock. On AT&T, this would have one looking at the 33 call for a $0.26 bid. On a 1000 share position an investor could sell 10 of these calls for $0.26 each, bringing in a total $260 credit. Now, $260 may not seem like much on a