Stock market bubbles don’t grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception. – George Soros

Currently, we see pressure on the dividend yields of many companies as they deal with a global pandemic. Many stocks have already recovered from their March lows but dividend yields are ready to be cut in order to shore up balance sheets. The Aberdeen Global Premier Properties Fund (NYSE:AWP), a close-ended fund, continues to have a current yield of above 9%. This helps investors as the share price remains under some pressure. Certainly, this is justified, but while there has been pressure on the real estate sector of late, I believe that the fundamentals of the sector haven’t changed drastically enough to warrant such a drop and current valuations are attractive for the holding.

Dissecting the fund

The factsheet of the Aberdeen Global Premier Properties Fund states that the primary objective is to achieve capital appreciation. So how does it achieve such a high rate of dividends, even during a crisis? A look at the composition shows that the fund has placed its investments across a large number of companies.

Source: Seeking Alpha

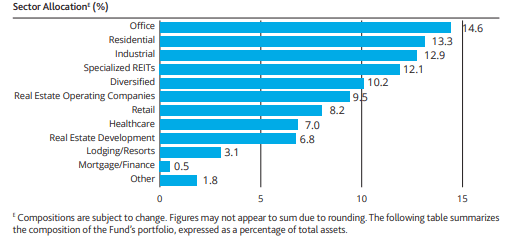

While it is concentrated in the real estate sector, the allocation within this domain is considerably fragmented. Office, Residential, and Industrial sectors command a 40% share in the assets, but the upside for investors is dependent on the performance of other sectors.

Source: Aberdeen Standard Investments

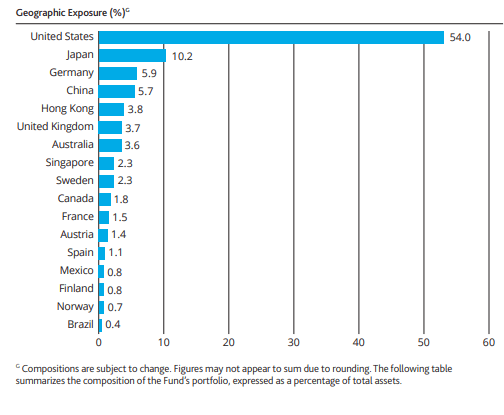

In terms of geography, the fund has almost half of its exposure in the US, with the remaining portfolio invested across a wide range of countries.

Source: Aberdeen Standard Investments

When analyzing a few companies in this fund, in order to understand the future of the holding, the top holdings are telling. Looking at the trajectory of them, we

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.