AT&T (NYSE:T) is one of the largest telecom companies in the world. The company has struggled since the start of COVID-19 to make any significant headway in its share price, as investors have moved towards "growth" stocks and away from "debt" stocks. However, with the Fed investing in AT&T bonds, now is the time to take a look at the near-7%-yielding common.

Debt Profile

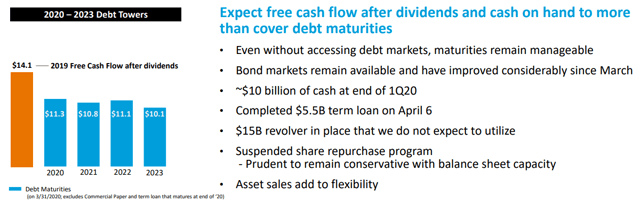

Since AT&T's acquisition of TimeWarner on the back of what most consider a poor acquisition of DirecTV, investors have consistently focused on the company's debt load.

Debt Towers - Investor Presentation

Specifically, AT&T's debt load reached an astounding $180 billion after the acquisitions, making it the single most indebted company in the world. Most investors balked at the sheer size of that number, refusing to invest in the company. However, in a low interest environment, leveraging up your balance sheet with debt is actually incredibly intelligent.

The reason is a simple. Let's say you're a $200 billion company and you leverage up with $200 billion in debt. You'd have to be in a business that's so intrinsic to customers' lives that you could withstand a recession. Fortunately, AT&T provides the content everyone consumes, the internet to their homes and businesses, and the cellular connections for their phones.

With that $200 billion in debt you pay, as interest rates hit record lows, roughly $7 billion in annual interest. The businesses you acquire generate $15-20 billion in annual cash flow, giving you $8-13 billion in annual "no strings attached" cash flow. The benefits of such investments, especially if they help diversify your core businesses, are clear.

Now these numbers are made up, but it indicates that investors shouldn't just throw out the company. And the potential benefits to investors are clear. In the two years since its debt peaked, AT&T cut

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.