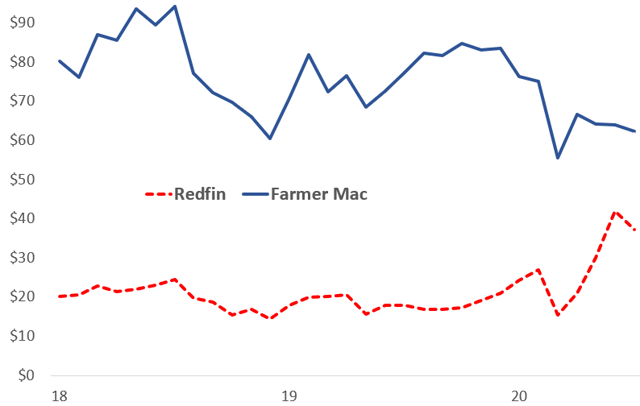

Being a value investor has been quite a challenge over the past few years. I have felt it personally when comparing my “best on best” – Farmer Mac, my best long idea, and Redfin, my favorite short. This chart shows that Redfin’s stock recently hit a record high, while Farmer Mac is down about 30% from its peak.

Source: Yahoo Finance

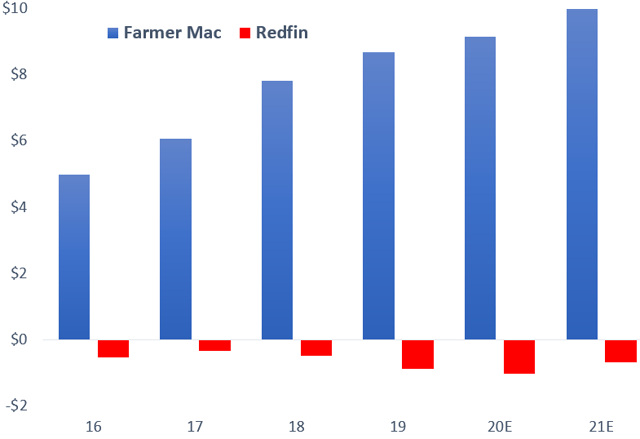

And here is the earnings comparison between the two companies:

Sources: Company reports, Yahoo Finance, Gary Gordon (My estimates for Farmer Mac for 2020 and 2021, my adjustment of Redfin EPS to operating earnings.

How does Farmer Mac’s stock decline while its EPS steadily rises, and Redfin’s stock rise while mired in steady losses? The stock prices clearly imply that the fortunes of these two companies will seriously reverse. This article addresses that possibility. It builds on my two prior Seeking Alpha articles on Farmer Mac – 1 and 2 – and my two on Redfin – 1 and 2. The first ones lay out my investment themes, the second are follow-ups.

I first lay out the operating stories for both companies. Then I present some valuation scenarios. I conclude that there is nearly no scenario that makes Redfin anywhere near as valuable as Farmer Mac.

Farmer Mac’s operating story.

Market share. Farmer Mac makes mortgage loans to, well, farmers, plus select other rural businesses. Farmer Mac estimates that its addressable market at present is $246 billion of farm mortgage and related loans. With $16 billion in loans, Farmer Mac has a 6.5% market share. Its competitors are primarily banks (mostly small rural banks), the Farm Credit System and insurance companies.

Revenue growth. Farmer Mac averaged 11% revenue growth from 2013 to 2019. Not too shabby. So it is clearly taking market share.

Profit margins. As capital-intensive businesses, lender profit