Here we are, the midst of what is expected to be one of the worst earnings seasons in recent history. Q2 earnings for some of the top companies in the US begin to report, and the full second quarter felt the brunt of the economic pandemic and shutdown.

We saw the sharp drop in the stock market in March only to witness one of the strongest rebounds now four months in, and still going strong. However, with earnings now giving us our first actual look at how things REALLY are for many businesses, we could see some selling pressures.

One of those companies due to report earnings this week is AT&T (NYSE:T). This is a favorite high-yield dividend stock of mine, as well as many others. Year-to-date the stock is still down over 20%. I like the tailwinds that are headed their way and should provide a boost to shares going forward.

The Year To Forget

As I mentioned above, AT&T is issuing their Q2 earnings this week, which will give us an update on how their HBO Max streaming service is doing and really how the company has been adjusting during this pandemic.

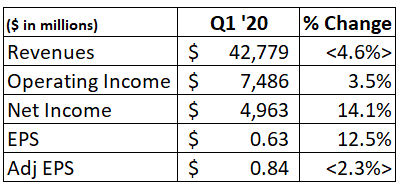

Here is a look back on how the company performed during the first quarter of the year, which had some COVID result sprinkled in towards the end.

Chart created by author.

In Q1, revenues for the company decreased 4.6% year over year, which could be attributable to the impacts of COVID. For example, the NCAA Men's Basketball Tournament was cancelled entirely, which accounted for millions in lost advertising sales. In addition, the company closed 40% of their retail stores, which attributed to less equipment sales. These two items alone led to a $600 million decline in revenue during the quarter.

The company pulled 2020

Historic Market Opportunity! Act Now!

The recent market crash has created exceptional opportunities. Many high-quality REITs are now offered at >10% sustainable dividend yields and have 100-200% upside potential in a recovery.

At High Yield Landlord, we are loading up on these discounted opportunities and share all our Top Ideas with our 1,800 members in real-time.

Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

Get Started Today!