Baker Hughes Stays Put For A Medium-Term Revival

In the medium-to-long-term, Baker Hughes (NASDAQ:BKR) looks to establish itself as a leading service provider in the natural gas and NGL-related business and clean energy industry. But, it has to overcome a few hurdles to reach there. As of now, the international offshore recovery has turned out to be elusive in the short term, although some still offer green shoots in the near term. The U.S. completions activity will stay muted in the next few quarters, as earlier expected. So, the company will look to add to its higher-margin products in the Digital Solutions segment. The $700 million cost reduction target is afoot, but its bottom-line will shrink from the remaining restructuring-related expenses in 2020.

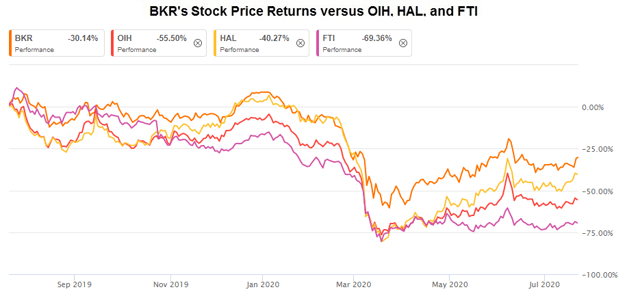

In Q2, the company's oilfield equipment backlog increased substantially, which can mitigate an otherwise falling revenue and margin potential in the next couple of quarters. I think BKR's stock price will stay depressed in the short term. However, the opportunities in the natural gas business, a robust balance sheet, and improved cash flows should provide upside in the medium-to-long-term.

The Market Outlook

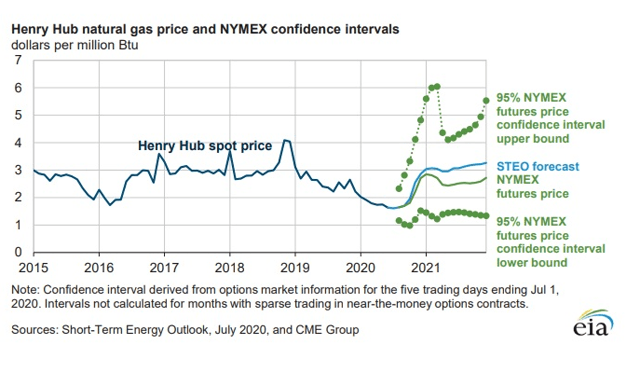

As an air of uncertainty weighs on the oil and gas markets, BKR's management sticks to its earlier forecasts of at least a 50% drop in the drilling and completion spending in the U.S. in 2020. So, it bets on structurally reducing the cost base and implementing various strategic initiatives to keep its household clean and protect the margin. It has recently sold the rod lift business and realigned the portfolio to gain a higher mix of industrial and chemical end markets. As part of its journey to servicing the clean energy market, it sees opportunities in the Turbomachinery & Process Solutions business, including efficient power generation, a compression technology that minimizes carbon emissions, and LNG equipment. Currently, the company has a global installed base of over