The iShares Self-Driving/EV And Tech ETF (NYSEARCA:IDRV) is a way investors can participate in rapidly growing electric vehicle industry while not placing too big a bet on Tesla (TSLA). Despite TSLA's recent pull-back from $1,750 to Friday's close of $1,415 (~20%), some investors - including myself - feel the stock has gotten way ahead of itself and is significantly overvalued. That said, it's hard to argue with Tesla's success in brand marketing, the China manufacturing plant, battery technology, and its potential to leverage its technology base into the home and industrial solar power and battery storage sectors. The point is: any long-term investment in the EV market obviously must include exposure to Tesla.

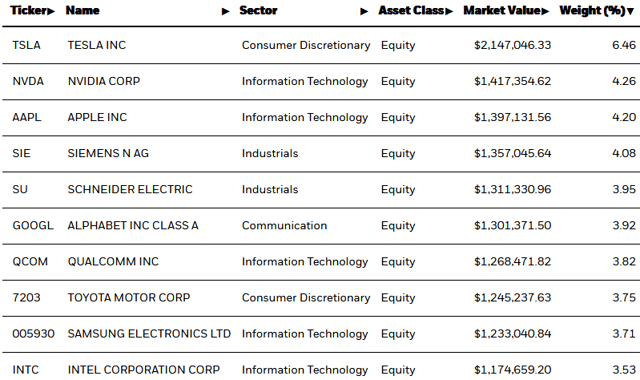

The IDRV ETF appears to be just such an investment. The list of the top-10 holdings is shown below:

As can be seen, IDRV has a 6.5% position in Tesla. I've been waiting for Tesla to pull-back before buying shares in IDRV. The prospect that Tesla will be added to the S&P 500 after achieving four straight quarters of positive net-income appears to be fully baked into the stock in my opinion. In addition, I am concerned Tesla may soon take advantage of its high flying stock to announce a common stock offering to finance the recently announced manufacturing facility to be built in Austin, TX.

Combined with the big drop in Intel (INTC) Friday (together INTC and TSLA equate to ~10% of IDRV's entire portfolio), it appears to be a good time initiate a position. Note IDRV was down -1.7% Friday.

I also find this ETF's diversified investment approach to the EV market very attractive. As one can see from the top-10 holdings above (which equate to roughly 45% of the entire portfolio), IDRV holds positions in key technology companies that will provide electronic chips and components to