I don't often write specifically on Intel (NASDAQ:INTC), despite buying the company from time to time when I see it as fairly valued or slightly undervalued. When the company suffered yesterday as though its business was in serious danger, however, it warrants a closer look to see just what we have to consider going forward in the long term.

Exposure-wise, my Intel position is comparatively modest. Broadcom (AVGO) is my largest position in the semiconductor industry, coming in at nearly 3.5% of my portfolio - Intel is well below 1% at this time.

However, after reviewing the numbers and forecasts, I decided to essentially double down on my position, with the potential for adding more if it drops further.

Let me show you why I did so, and why I think you should as well.

Intel - How has the company been doing?

Let's quickly recap the company here, as news like these has a tendency to make investors - including myself - focus entirely on the quarterly-specific trends as opposed to what the company is and does.

Intel Corporation is the world's largest and highly-valued semiconductor manufacturer in terms of revenue (though perhaps this may be subject to change going forward), incorporated in Delaware. Its main business is the researching/developing and supplying of microprocessor chips to Apple (AAPL), Lenovo (OTCPK:LNVGY), Dell (DELL) and HP (HPE), among others. It also manufactures critical components such as controllers, chipsets, integrated circuits, flash memory, graphics chips, and embedded processors.

53% of Intel's 2018 sales continued to be focused on desktop and notebook computer components, but this has steadily been declining (including in 2019) in favor of tablet and smartphone chips. The remaining 47% of sales originate in flash memory chips for storage, IoT applications and data center processing products.

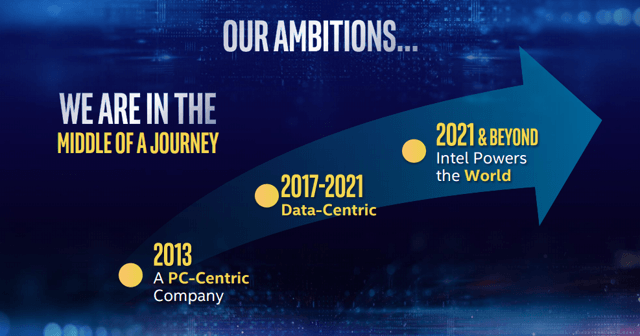

(Source: Intel 2019 Investor's Meeting)