Introduction

In this article, I will discuss why I believe a potential spin-off of Unilever's (NYSE:UL) food division can create value for shareholders, and I will elaborate why there is a serious possibility that it will occur in the following years.

Valuation

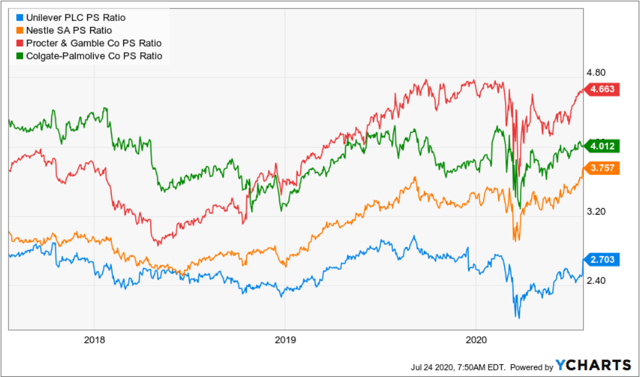

Over the last few years, Unilever's valuation has been relatively cheap compared to its competitors. Currently, its price-to-sales ratio is significantly lower than its peers, and its EV-to-EBITDA ratio at 14.71 is also the lowest amongst those same contestants. Yet, Unilever's operating margin is quite powerful. When looking at the underlying organic growth of each company, investors can conclude that Unilever's relatively low organic sales growth results in the discount.

| Organic Sales Growth in Q1 2020 | GAAP Operating Margin | |

| Unilever | 0.2% | 18.2% |

| Procter & Gamble (PG) | 6% | 20.1% |

| Nestlé (OTCPK:NSRGY) | 4.3% | 17.6% (underlying operating margin) |

| Colgate-Palmolive (CL) | 7.5% | 23.2% |

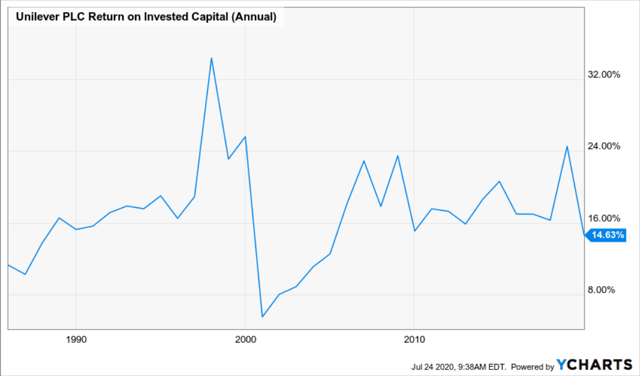

Unilever needs to spin off its slow-growing divisions and concentrate its efforts in markets where it can obtain high margins and adequate organic sales growth. This can enhance the company's return on invested capital, which has stagnated for the last decades.

Food

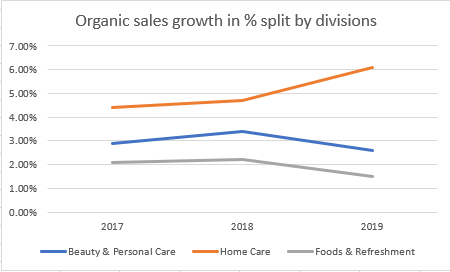

I will showcase that Unilever's food division lack of growth is partially the reason for its lower valuation. Organic sales growth of the foods & refreshment division has been lacklustre for years, and when accounting for inflation, the division practically did not grow in 2019. Home Care is currently the company's growth engine - in 2019, organic sales grew by 6%.

(Visualized in Excel, data from Unilever IR)

The Beauty & Personal Care division has also experienced a relatively low organic sales growth. However, its operating margins are considerably broader, and have been expanding for years. The Food & Refreshment division has not been able to expand its operating margins significantly. Home Care's massive organic sales growth also fueled a massive gross