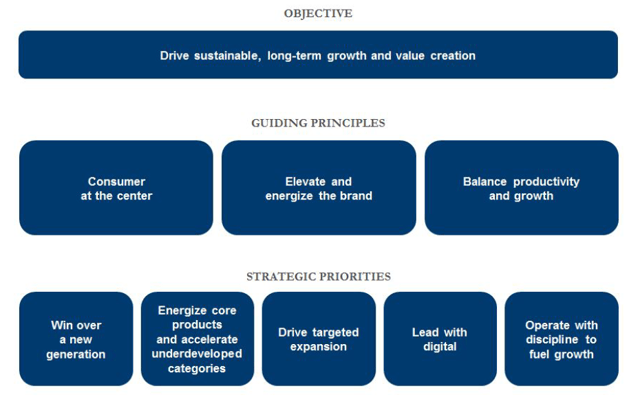

Image Shown: Ralph Lauren Corporation’s long-term goals. Image Source: Ralph Lauren Corporation – Fiscal 2020 Annual Report

By Callum Turcan

The apparel, fragrance, and accessory company Ralph Lauren Corporation (NYSE:RL) suspended its dividend in late-May 2020 after reporting its fourth quarter fiscal 2020 earnings (period ended March 28, 2020) in the face of the coronavirus (‘COVID-19’) pandemic. Given Ralph Lauren’s net cash position and quality cash flow profile (relatively low capital expenditure requirements to maintain its revenue generating abilities), this move came somewhat as a surprise. COVID-19 has been wreaking havoc on Ralph Lauren’s normal sales channels as physical retail outlets that sell its products have been forced to shut down for extended periods of time to contain the pandemic. Once the pandemic starts to come under control, a process that would become much easier if a COVID-19 vaccine is discovered, Ralph Lauren would likely be in a position to resume its quarterly dividend payouts.

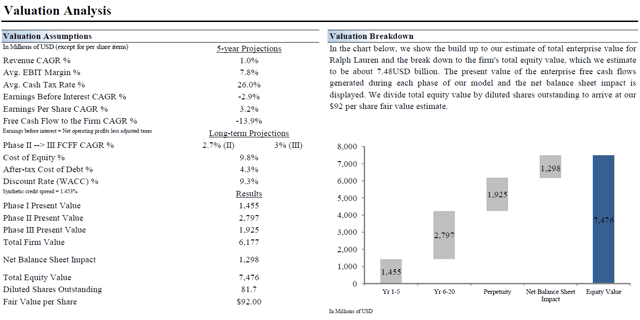

Through our rigorous discounted free cash flow analysis process, we give RL a fair value estimate of $92 per share. This analysis involves forecasting Ralph Lauren’s future free cash flows into perpetuity, discounting those forecasted free cash flows by the appropriate rate, then taking net cash/debt considerations into account (and probable future liabilities, such as pension obligations or potential legal settlements). In the upcoming graphic down below, we highlight the key valuation assumptions used to arrive at our fair value estimate of $92 per share. Please note that at the low end of our fair value estimate range (assuming Ralph Lauren significantly underperforms our key valuation assumptions laid out down below), we give RL a fair value estimate of $74 per share, still modestly above where shares are trading at as of this writing.

Image Shown: We give shares of Ralph Lauren a fair value estimate