High Yield With Deep Downside Protection: Ideas For Navigating The Virus Economy.

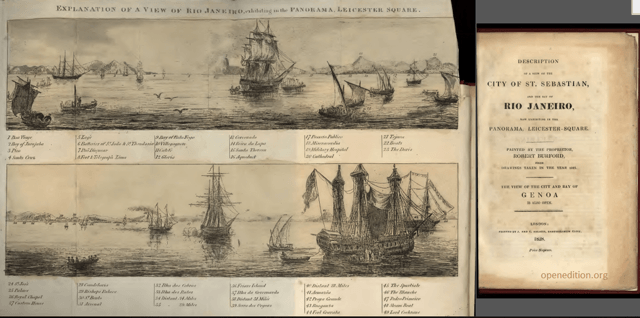

This is an 1828 sketch of one of the world's greatest natural harbors, Guanabara Bay in Rio de Janeiro. Since the discovery on January 1, 1502, this bay has been providing a safe harbor from the storms that ravage the world.

Each day, as news of existing and potential new financial headwinds blow across the news feeds, I am reminded of this grand harbor just 60 miles from my home here in Brazil. I have developed Engineered Income Investing as a toolbox of strategies to serve as a safe harbor in the turbulent seas investors sail. High yield with deep downside market protection is just one such tool in our kit. Today, I provide 3 actual current market-priced examples using this strategy to engineer an 18% annualized yield rate with 11% downside protection, 21% yield rate with 8% downside protection, and 19% yield rate with 11% downside protection.

Great uncertainty continues to cast a dark shadow over markets even as they near full recovery from the recent deep and steep virus bear market. In an effort to help readers find and enter attractive positions quickly, I am starting a new periodic HYDP (High Yield - Deep Protection) series theme. These are ideas where I present a list of very solid, recession-resistant (or already with recession pricing built-in) companies that are long-time favorite targets of mine for high yield income generation at lowered market risk. All such targets in these presentations are already covered in full-featured analysis reports archived my body of public work and Engineered Income Investing, available to subscribers and all Seeking Alpha Premium users. As such, I will leave it to readers to review those earlier, more in-depth reports for a greater understanding of the companies. Here, in the HYDP series, I will focus on a brief summary of reasons I like the target

Stop Chasing Yield. Get Help Engineering high yield from high quality safe dividend stocks while reducing downside market risk.

Your subscription includes:

- Exclusive access to E.I.I. Strategy, developed to boost cash income & yield from quality dividends while reducing (but never fully eliminating) market risk.

- 5+ monthly opportunities using specific strategies and trade pricing to enter/hold/exit according to value, including covered option writing + dozens of quick look ideas.

- Personal access to the winner of Seeking Alpha's prestigious Outstanding Performance Award.