There is always darkness before the dawn. It is a literary metaphor, but also a mathematical one: at the highest point of a parabola, the curve plateaus and then begins to recede. Nothing goes up forever.

The COVID-19 worldwide pandemic is on the verge of running its course in the USA.

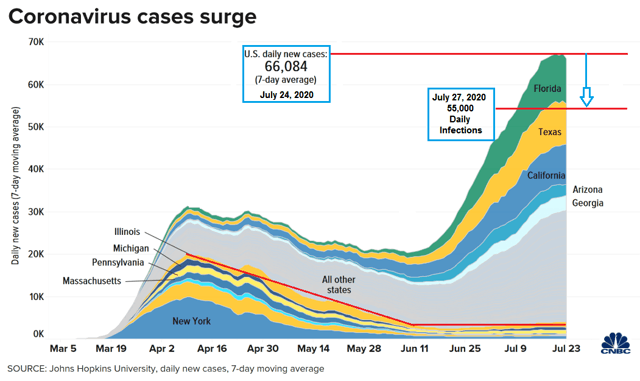

This chart (above) quickly reveals some important information. Five states (New York, Massachusetts, Pennsylvania, Michigan and Illinois) experienced a massive 4-week surge in COVID-19 cases from March 14th to April 14th, along with the rest of the United States. But in their case, they responded aggressively and their curve receded dramatically. It has remained flat since June.

These 5 states contain large urban areas (Chicago, Boston, New York City, Philadelphia, Detroit), so big cities were not used as an excuse for being unable to reduce their infections.

Most of the other 45 states are now taking similar, aggressive actions to reduce their infection numbers. Once that mindset is firmly established, results can come quickly. In the 5 states mentioned above, new infections were reduced by 50% within a month (May 14th) and by 90% in June (from their peak).

The Wall Street Journal published updated news today on the virus: "U.S. Coronavirus Cases Rise at Slowest Pace in Weeks: New infections rise by 55,000, the lowest daily figure since July 7," by Allison Prang, July 27, 2020.

New daily infections are now down by 11,000 from the most recent 7-day average on Friday, July 24. It appears the parabola of infections in the USA is breaking and people are finally being more careful.

There was also good news on the vaccine front: "Over a million doses of Oxford/AstraZeneca COVID-19 vaccine possible by September - researcher," by Alistair Smout, Reuters Health News, July 20, 2020. The article