By Federico D'Anna

At the Q1 conference call, CEO Alan Jope took a very cautious tone about Unilever (NYSE:UL)(UN) for Q2. Indeed, markets were wary too after the call, with Unilever melting down over the course of the day. Unilever has a highly diversified portfolio of products, and the caution was strange given how many significant product categories were likely to see resilience from the shock that the pandemic had caused. What Q2 has shown is that the tone was merely conservative, as Unilever delivered superb results, with sales staying flat with a momentous rise in FCF. The key takeaway here is that FCF grew because of working capital improvements, not CAPEX deferrals, and with the picture of flat sales, Unilever demonstrates its quality. With a 3.7% dividend yield upheld by UL's strong economics and positioning, we would definitely consider it as a high-reliability income pick.

Q2 Results

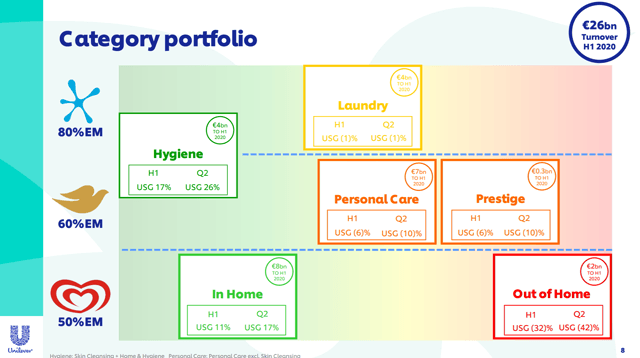

Q2 results were strong from a turnover point of view. Product categories, such as hygiene and in-home saw substantial growth which offset weaker categories like out of home which was not resilient for very obvious reasons. Laundry as expected didn't vary too much, with people's clothing habits staying more or less the same, but there were declines in personal care as people opted for fewer cosmetics in a time where they'd be interacting with far fewer people.

(Source: H1 2020 UL Pres)

(Source: H1 2020 UL Pres)

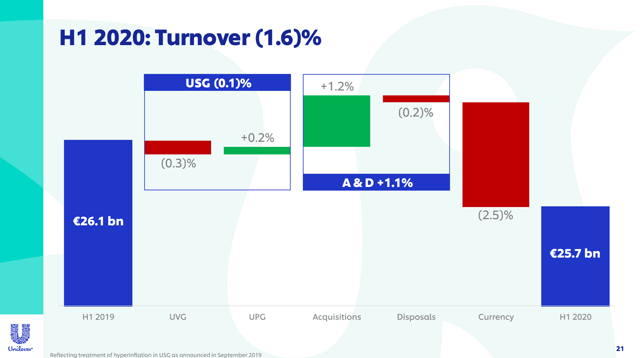

Taking away more transitory and punctuated effects like acquisitions and currency, the revenue picture is one of stability. Even taking into account currency effects, which were not irrelevant due to UL's substantial emerging market exposure, the decline was rather marginal of only 1.6%.

(Source: H1 2020 UL Pres)

Nonetheless, these currency effects are likely to wane, as the state of the pandemic in these countries is in the worst state possible right