Calix (NYSE:CALX) had been seeing some green shoots since the fiscal end of the last year. The current pandemic has led to a full-blown mid to high teens growth for a company that had been struggling to grow revenue for the previous few years. Coupled with the momentum in the current environment, the needs of service providers to understand better subscribers is likely to keep Calix relevant over the coming quarters. Not only is the revenue growth expected to be driven by a product mix shift towards software but also the consequent multiple expansion could lead to 20%+ gains.

Business

Calix is in the business of providing solutions to communication service providers or CSPs to enhance the monetization of CSPs' platforms. Calix's platforms help CSPs monitor, analyze and act on insights from subscriber behaviour.

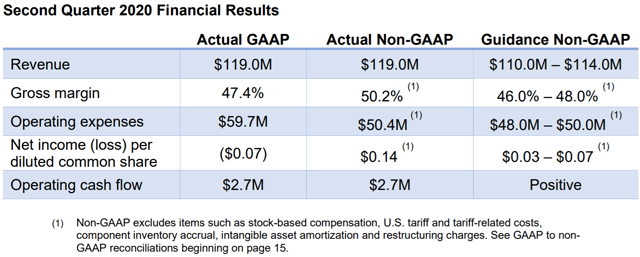

2Q20 saw a consensus beat across revenue and margins owing to a pull-forward effect due to COVID-19 induced loads on the CSPs.

Source: 2Q20 Letter To Stockholders

The management noted that majority of the beat was due to the change in environment and some of the outperformance could also be attributed to more structural reasons such as the increasing software component in Calix's sales due to customers wanting to accelerate their transformation.

Source: 2Q20 Letter To Stockholders

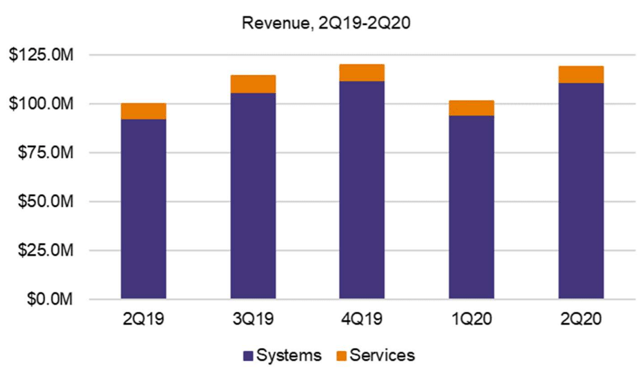

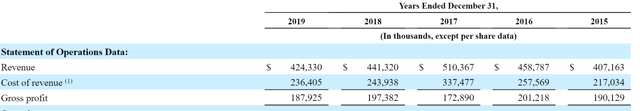

The considerable momentum in the company's sales is evident from the comparison vs the track record of the last few years.

Source: 10K – 2019

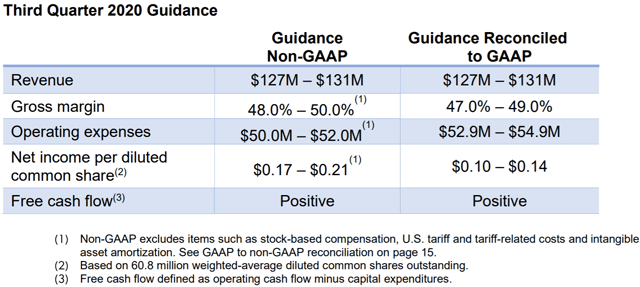

The downward trajectory of the last few years appears to have reversed course, leading to the company giving out rather strong guidance for 3Q20.

Source: 2Q20 Letter To Stockholders

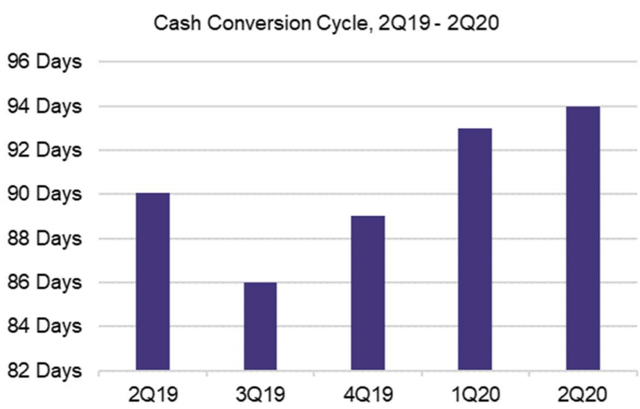

Another interesting aspect of Calix's business was the expansion of the company's cash conversion cycle.

Source: 2Q20 Letter To Stockholders

Despite a fall in the days sales outstanding (+10 days y/y), the management attributed an increase in

Ideas similar to the ones discussed in this article take a lot of time to develop. We run the Absolute Return Ideas on Seeking Alpha that discusses more frequent, shorter-term trading bets based on back-tested strategies. Join us for a free trial now!