Thesis Summary

TheFidelity MSCI Utilities Index ETF (NYSEARCA:FUTY) is an exchange-traded fund that is launched by Fidelity Covington Trust. Fidelity MSCI Utilities Index ETF (FUTY) tracks a market-cap weighted index of stocks in the US utility sector.

This ETF has an expense ratio of 0.08%. The stock invests at least 80% of its assets in the fund underlying index and the securities included. This index is called the MSCI USA Investable Market Index (IMI). It gives us the performance of the utility sector in the US market. Although, like any other investment platform, investing in this fund also attracts some risks.

FUTY offers stability in its investment. This makes it one of the reasons why I would always advise investors to invest in it.

ETF Overview

FUTY has an MSCI ESG Fund Rating of 7.13 out of 10. The MSCI ESG Fund Rating tracks the resiliency of portfolios to long-term opportunities and risks that arise from governance, social, and environmental factors. FUTY is a fund that always seeks to match its performance with that of the MSCI USA IMI Utilities Index before fees and expenses.

The fund is sponsored by Fidelity and has since its inception in 2013, amassed over $812.90million worth of assets. This makes it one of the largest ETFs that attempt to match its performance with standard Utilities.

Funds like this, which are properly managed to reduce risks, must have a regulated portfolio.

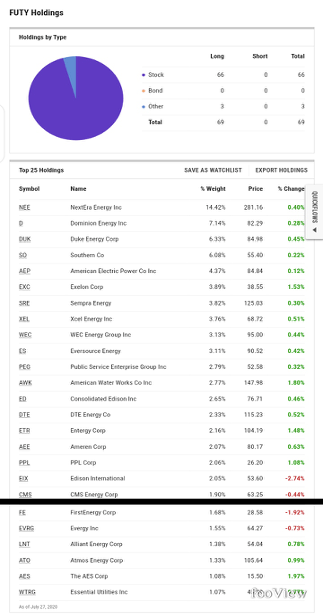

Let's consider the FUTY holdings in the chart below:

Source: Ycharts

This chart shows the list of FUTY holdings. FUTY provides diversified exposure to the fund. The diversification of stock reduces the single stock risk to its minimal. NextEra accounts for 14.42% of the total asset which is the highest percentage any of the funds single holding accounts for. The percentage of asset Dominion accounts for is 7.14%, this put