ETF Overview

Vanguard Utilities ETF (NYSEARCA:VPU) owns a portfolio of U.S. utility stocks. The fund seeks to track the investment results of the MSCI US Investable Market Utilities 25/50 Index. Despite near-term headwind caused by COVID-19, most stocks in VPU’s portfolio will continue to invest in their capital projects to grow their rate bases and EPS in the next few years. The Federal Reserve’s decision to not increase interest rate at least until 2023 may help support these stocks’ valuations as investors continue to seek quality utility stocks that pay attractive dividends. Therefore, we think VPU's fund price is well supported. The fund is a suitable choice for investors seeking both capital appreciation and dividend growth.

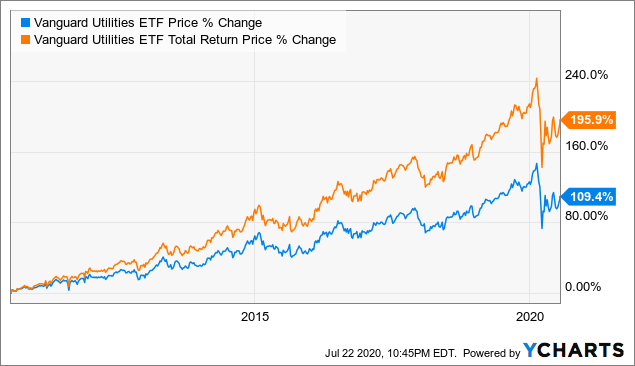

Data by YCharts

Data by YCharts

Fund Analysis

Near-term headwind caused by COVID-19 but long-term growth outlook remains intact

Most companies in VPU’s portfolio have been impacted by the outbreak of COVID-19. During the peak of the extensive lockdowns (in April), electricity and natural gas consumptions have been down by about 5-10% depending on the severity and the services territories that these utilities operate. For those who are interested, we have analyzed a few utilities companies in the past few months (Click here, and here to read the impact of COVID-19 on Xcel Energy (XEL), and American Electric Power (AEP), respectively). As lockdown measures relax, we expect the impact to gradually recede. In addition, many stocks in VPU’s portfolio have also initiated cost-saving initiatives in order to mitigate the impact. Most of these companies have not changed or delayed their capital projects and these projects are well-supported by their strong balance sheets. Therefore, their long-term growth outlooks remain intact. These investments should also result in rate base growth, and EPS growth (usually in the ranges of 4-8% annually) in the next few years.

Morningstar Moat Status | Financial |