Investment thesis

Danone (OTCQX:DANOY) (OTCQX:GPDNF) is a very mature and stable company that currently trades at a fair price. As people have stockpiled products of big consumer packaged goods companies during the current coronavirus pandemic crisis, Danone was poised to benefit from this exceptional consumer behavior. This supposed tailwind was supposed to temporarily boost sales and revenues, which would help the company throughout its deleveraging process. H1 results proved that was not the case, although the results were not bad after all. The company currently pays a ~3.50% dividend yield, which is very high compared to the past. Still, the company has ample resources to continue paying it. From this point on, buyers should expect a 3.50% yield, which should grow along with inflation and a slight organic growth over time. For this reason, now is a good time for dividend growth investors to consider adding a small position, while waiting for a possible further drop in share price in case lockdown measures come back to the lives of consumers in the short term.

A brief overview of the company

Danone is a French agri-food multinational founded in 1919. It is the largest French consumer packaged goods company and its main specialty is dairy products. This century-old company was founded in Barcelona. Back then, the entire Danone's universe that we know today was still formed by just a small yogurt factory located in the Raval neighborhood. Today, Danone employs over 100,000 people around the world, and operates in more than 120 countries.

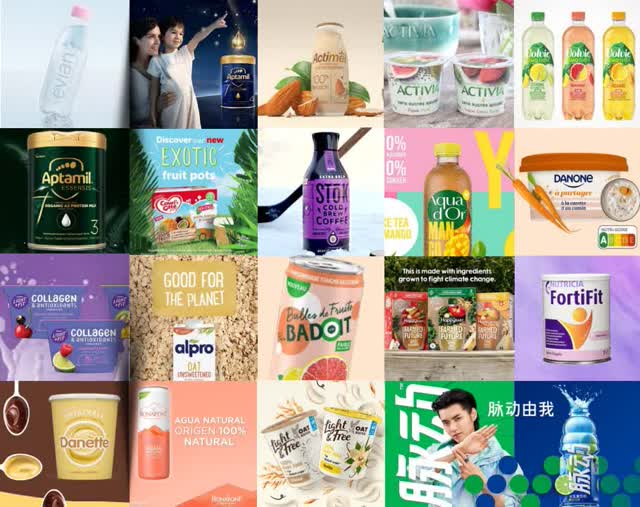

Source: Danone's website

Their main brand is Danone, a yogurt-based brand that sells yogurts and drinking yogurt of all kinds of flavors, including strawberry, banana, blueberries, and kéfir, but their portfolio of brands include an immense range of products, including probiotics, smoothies, purees, custards, protein-based beverages, and a big, etc. Their brands generally include gluten-free, lactose-free, and fat-free versions, and have been constantly adapting to