Finding an Appropriate Cap Rate

Within a reasonable range, the aggregate cap rate for the 12 properties owned by Global Self Storage (NASDAQ:SELF) can be estimated. Examining the most current corporate presentation of SELF renders considerable insight into the quality of the portfolio:

- Good economic demographics.

- Good visibility and effective signage.

- Situated close to a metropolitan area.

- Relatively recently constructed.

- Typical size between 70,000 and 80,000 square feet.

- Decent hurdles for new competitors.

- Supervisory professional management and highly trained on-site personnel with emphasis on customer service.

- High-tech security with automated gates and camera monitoring.

- Product diversity in unit size offerings and mixture of climate-controlled and traditional.

- Internet and technology to facilitate rental, and such devices as self-service kiosks situated on site.

- Directed strategic marketing programs with strong media presence.

- Sophisticated monitoring of local markets and dynamic adjustment of prices.

- 24/7 call service centers.

Most certainly, SELF'S properties demonstrate the highest and best REIT characteristics.

Although assigning a definitive cap rate to any single property will depend upon a number of local factors, we can construct a reasonable range of portfolio estimates in three ways:

- Access what relevant cap rate survey information might be available from established public sources.

- View listings of similar properties on realtor websites.

- Perform computations of embedded cap rates implied by the market pricing of other publicly traded REITs.

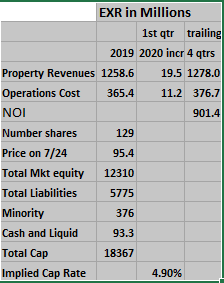

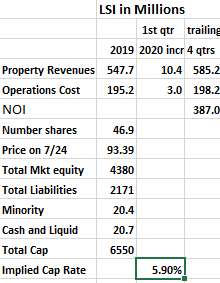

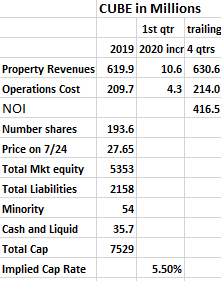

The information that can be derived from public sources (1 and 2 above) suggests a range of between 5% and 6%. However, the most reliable approach is to produce analysis that is contained in Exhibits 1, 2 and 3 below using specific data for three other self-storage REITs: Extra Space Storage (EXR), CubeSmart (CUBE) and Life Storage (LSI).

Exhibit 1

Exhibit 2

Exhibit 3

In examining each of the above, please note that the 2019 property revenues