After the latest turn in a surprising, headline-grabbing bidding war for Guyana Goldfields (GUYFF) that has punctuated the start of a new bull market in gold, China's Zijin Mining (OTCPK:ZIJMF) won shareholder approval last week for a deal that will see them acquire the 5.7 million ounce Aurora gold operation in Guyana.

With the approved offer of C$1.85 per share for Guyana, they've beaten two other would-be acquirers with an all-cash deal worth US$237 million. The offer represents an eye-watering 340% premium to the last close of Guyana's shares before the initial C$0.60 bid announced back on April 27, for a company that many investors and analysts had left for dead after a long string of operational issues at their Aurora mine in South America.

This move continues a torrid pace of M&A by Zijin, a gold mining behemoth with a US$20 billion market cap, after closing the US$1B acquisition of Continental Gold just this March. That deal came only a year after another blockbuster takeover, that of Nevsun Resources and its highly prized copper-gold Timok project in Serbia, edging out rival Lundin Mining's hostile offer with a US$1.4B all-cash bid.

One of the companies they topped with this latest aggressive offer is a fellow gold producer with an existing interest in the gold-rich jungles of Guyana: Gran Colombia (TPRFF).

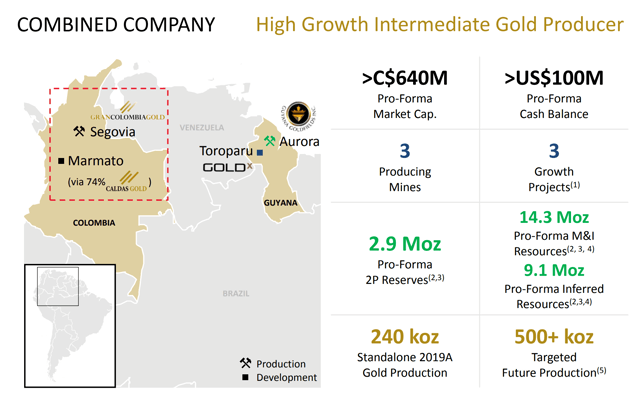

Gran Colombia's planned acquisition (Source: Company presentation)

Gran Colombia's planned acquisition (Source: Company presentation)

On May 11, Gran Colombia had launched an ambitious 3-way merger proposal that involved acquiring both Guyana Goldfields and nearby developer Gold X Mining (SSPXF), a company in which they already have a 19% stake. The motivating factor for the deal was the synergies between Guyana's producing Aurora mine and Gold X's massive 10 million ounce Toroparu development project, only 50km away. Management had estimated US$200 million in savings and combined annual production of over 500,000