Source: Google

Alphabet, Inc. (GOOGL, NASDAQ:GOOG), known simply as "Google", is the provider of the world's largest search engine. The technology giant also provides a range of other offerings including digital content, hardware, and other services. Google dominates the Internet by consistently gaining and retaining users through its many products and services which redirects users back to Google Search.

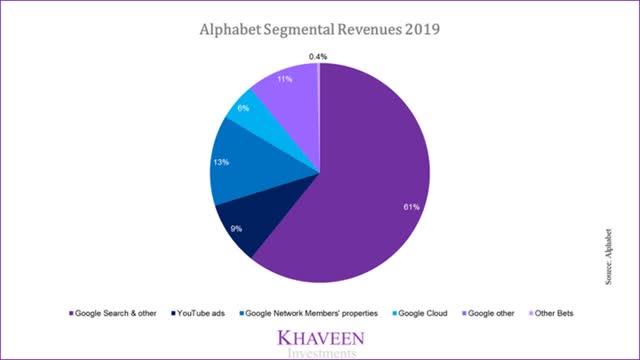

At the heart of it, Google is a Media & Entertainment company that derives majority of its revenue through advertisements. As seen below, 70% of its revenue is generated through Search and Youtube Ads.

Source: Google

Google's revenue has grown at an impressive average annual growth rate of 21.05% over the past 10 years. Despite the COVID-19 pandemic, the company's revenue only declined 1.7% Y/Y in the latest quarter. While many point out that Google's non-ad segments would drive the company forward, we believe that Google's ad revenue still has legs to stand on.

To accurately determine how much upside Google's stock price has, we had to accurately project its revenue growth. However, doing so is indicate, as we not only need to project its expected market share change, but also the growth of the digital ad market. Hence, in order to determine digital ad market growth, we had to first establish the relationship between Internet usage and the digital ad market.

The Transition to the Internet

The transition to the online world has been attributed to growing connectivity globally, especially in emerging markets where government policies and capital access lead to improvements in communication networks. As of June 2020, there are an estimated 4.83 bln internet users worldwide based on Internet World Stats, or in other words, 62% of the population is on the internet.

Furthermore, the recent COVID pandemic has only expedited this transition. In the past, many may have referred to