Danaos (NYSE:DAC) reported second-quarter earnings on August third, with a strong performance despite the macro environment and declining charter rates. The company's impact from COVID-19 and re-charters is overall likely to be minimal. Further, the company's shares remain quite cheap and the company has approved a buyback.

Earnings

Danaos' second-quarter results were good, largely due to long-term stability from more valuable charters, and the benefit from scrubber attachments completed in the first half. Adjusted EBITDA up 6% year over year to $80.1 million. Earnings per share of $1.71 versus $2.24 for the previous year were surprising, coming from a 23.9% increase in adjusted net income, offset by a higher share count. The impact of COVID-19 was felt to the tune of $3.2 million in operating revenues, with future quarters likely to have a lesser effect, barring, potentially, the third quarter. Overall, a strong quarter in the environment.

Charter Risk

The company's second-quarter results with operating revenues up 4% year over year were roughly in-line with my estimates based on potential re-charters of 4.5%. Unfortunately, where we stand now, the situation has changed significantly.

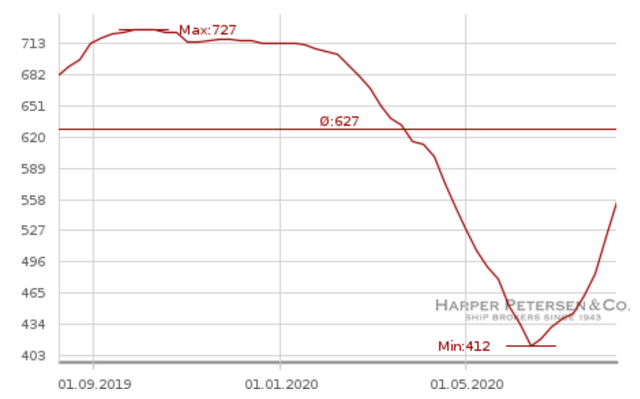

As a result of COVID-19 and the resulting economic recession, charter rates took a steep dive starting in February. They have since begun to rebound at a fast rate. Danaos has numerous vessels due to be chartered this year, below is my analysis of the potential impact on the company at current rates.

Danaos Re-chartering Estimates

TEU Class | Current Charter Rate of Vessels Available for Re-chartering by year-end 2020* | Market Rate | Number of Vessels to be Re-chartered | Potential Annual Revenue Increase |

8,500 | $19,500 | $22,000 | 1 | $0.895M |

6,500 | $17,500 | $17,500 | 2 | $0M |

4,250 | $10,000 | $11,000 | 7 | $2.506M |

3,400 | $10,000 | $9,500 | 8 | -$1.432M |

2,500 | $10,333 | $8,200 | 3 | -$2.290M |

2,200 | $9,500 | $7,500 | 8 | -$5.728M |

Cumulative: | 28 | -$7.045M |