I have separated my long-running Investor section from Weighing the Week Ahead. My hope is to highlight ideas for the long-term investor. In my last investment post I applied the key concepts of the matrix to a range of investment ideas. We have been on target so far with what to avoid, and I expect the approach to guide us to the best long-term investments.

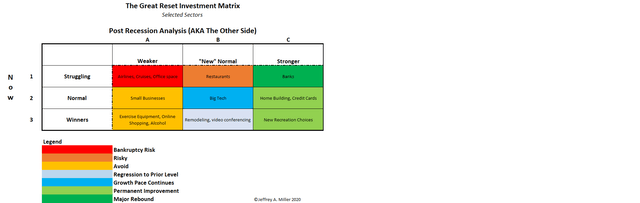

For now, and for as long as the pandemic weighs on the market, that is the necessary context for each stock idea. To provide a starting point, I created The Great Reset Matrix. The Matrix is a conceptual guide, which I use in evaluating every new stock idea. The current version draws upon results from the Great Reset Project, where readers have joined in to help with my Wisdom of Crowds approach. The results may seem like common sense. Good! Comments from industry experts and analysts are often quite different. This is one way we will find an edge. You can see past research or become a part of the project by signing up for a free membership. I will continue to disseminate results in posts like this one, and you can help.

The current matrix version looks at sectors, not individual stocks. Many sectors are not yet listed. You may disagree with the placement of others. If so, the matrix is doing its job – encouraging us to think about what is most important.

This Week’s Ideas

Each idea I include comes from a respected source that I have often cited in the past. In each case I offer a comment about how I might use the stock in client portfolios. I also assign a matrix classification. Comments are most welcome. Please join me in a discussion of the classification as well as contributing other ideas. I hope that

My new Marketplace service, Yield Boosting Corner, is off to a fast start. The concept, selling near-term calls on solid stocks, is one I have used for the last seven years for my investment clients. It is a great addition for income investors who would like to have another club in their bag.

You will quickly learn how Yield Boosting Corner compares to other income approaches. I’ll have at least one new idea each week as well as follow-ups on managing a portfolio. Start today with a two-week free trial!