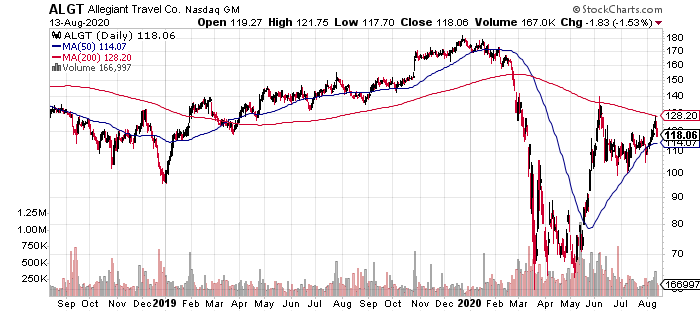

The airlines have been an interesting industry to watch this year, to say the least. Travel all but stopped earlier this year due to global shutdowns, and to a large extent, much of the world is still either closed off, or operating at reduced capacity. Small wonder then that airline stocks were absolutely crushed starting in March of this year, with one example being Allegiant Travel (NASDAQ:ALGT).

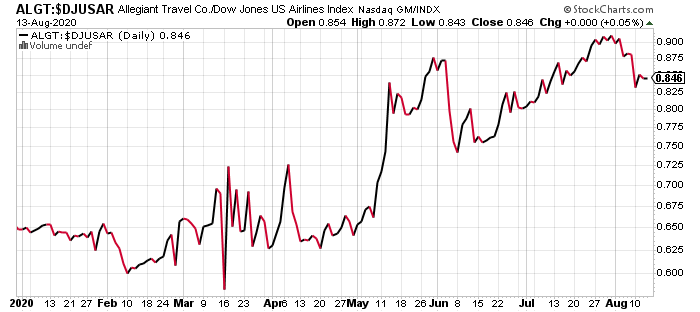

The budget airline operator has been a strong performer for years, focusing on profitable routes and no-frills service that has resonated with spending-conscious consumers. That performance has extended to the stock as well, as we can see below, with a YTD comparison between Allegiant and its industry group.

Allegiant has continued to grow in a variety of environments and while this year is an ugly exception, I think the company's operating history and outperformance of its peers will continue for years to come. That makes the stock worth a look on the long side.

Favorable fundamentals

Allegiant's model isn't necessarily a new or different way to run an airline; it operates in much the same way as the other budget carriers. However, Allegiant has executed extremely well in the past in terms of selecting routes and flying them with low costs.

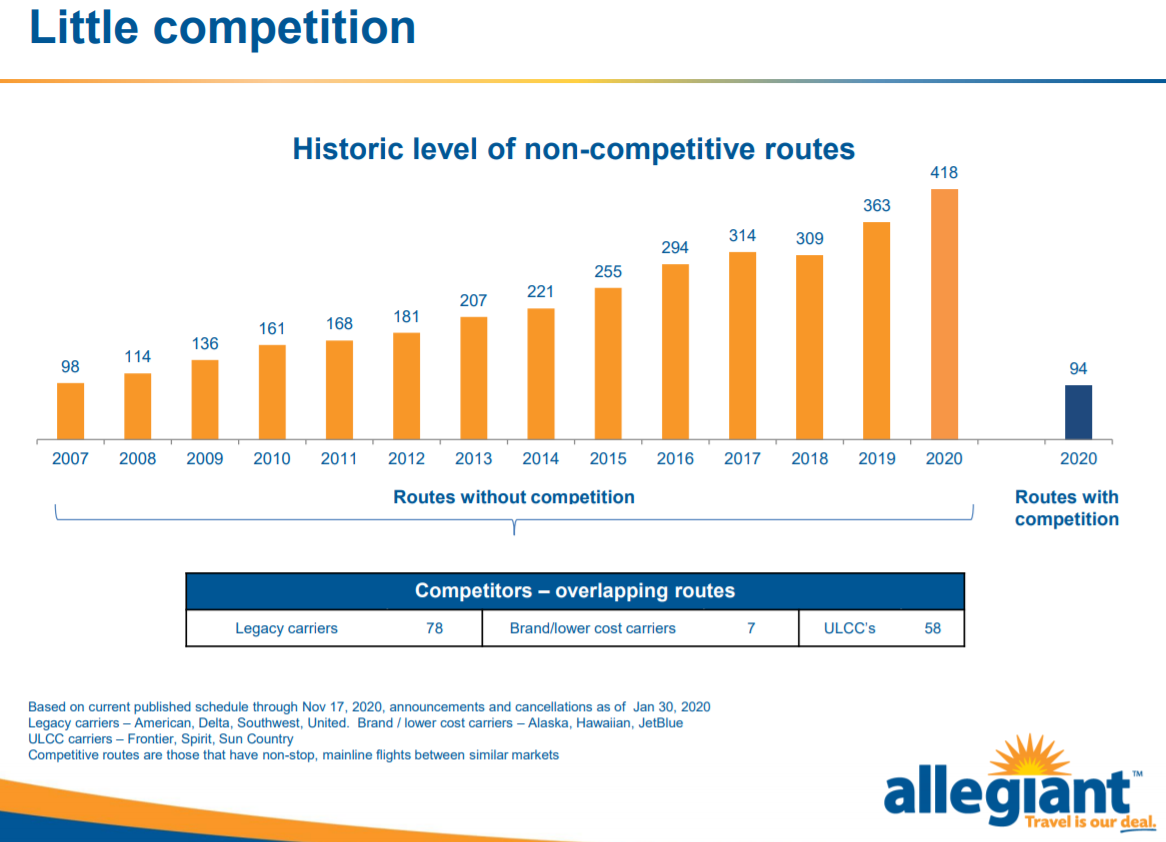

Source: Investor presentation

Allegiant's strategy is centered around flying routes with little or no competition, which affords it some pricing power, but also a captive audience. Indeed, if there is perhaps one alternative - or in a lot of cases, no alternative - for a particular route, Allegiant can set the schedule according to its assessment of the most profitable way to run that route. Repeat that a few hundred times over, and you have an airline with a very profitable network of routes.

For this strategy to work, operating costs have