Mortgage REITs (REM) are very popular among individual investors because they pay high dividend yields. It's not uncommon to get >10% yields from mREITs, compared to just 4% for traditional equity REIT (VNQ).

As a REIT analyst, readers regularly ask me what I think about them.

My answer always is the same:

- They are very cheap after the recent crash.

- Some of them offer good upside potential paired with high income.

- But to the most part, this is a sector that I prefer to avoid.

In nine cases out of 10, we favor traditional equity REITs over mortgage REITs, even if that comes at the cost of a lower yield.

Below we explain why:

Poor Business Model With Limited Value Creation

When you invest in a REIT, your goal is gain exposure to real estate investments that will pay you high rental income (in the form of dividends) and allow you to profit from long-term appreciation.

In a nutshell, this is the business model of equity REITs.

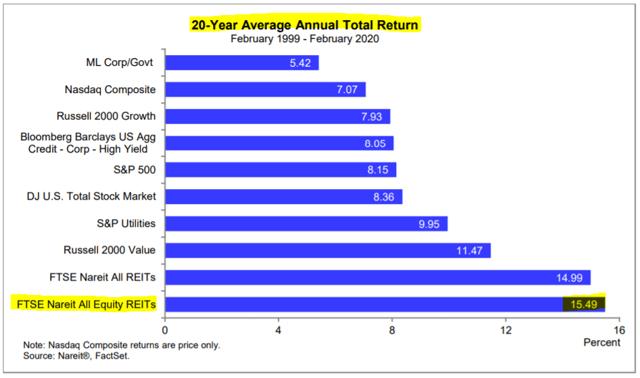

They raise capital, invest it in properties, collect rents, create value, and wait for appreciation. It's a simple, yet highly effective business model that has generated 15% average annual total returns over the past 20 years:

Many investors make the mistake of thinking that this also is how mREITs operate. In reality, it's day and night.

The business is closer to that of a bank than a landlord. They earn profits by sourcing capital at cost x – lending it at rate y – and earning the spread in between. It may work well for a time, but it's less desirable than owning the properties in the long run.

Why is that?

First off, mREITs are very dependent on interest rates, which are completely out of their control and often very difficult to

What Else Are We Buying?

We are sharing all our Top Ideas with the 2,000 members of High Yield Landlord. And you can get access to all of them for free with our 2-week free trial! We are the #1 ranked real estate investment service on Seeking Alpha with over 2,000 members on board and a perfect 5 star rating!

You will get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!

Get Started Today!