We are usually looking for companies that generate consistent cash flows to be able to predict their potential returns more accurately. As a result, we avoid cyclical stocks whose sales can fluctuate wildly based on macroeconomic events, such as companies that produce semiconductors.

However, some stocks in the computer hardware sector offer considerable tangible returns, and trade at an attractive valuation, which could result in investable opportunities. One such stock is Seagate Technologies (NASDAQ:STX), which offers data storage products and data storage solutions. Despite its cyclical business model, the company has built a relatively solid dividend record over the past decade. With shares yielding a considerable 5.77% attached to a P/E at the low teens, let's assess whether Seagate is worth investing in.

In this article, we will:

- Go over the characteristics that make Seagate investable

- Discuss the potential flaws and risks

- Assess the stock's future return potential

- Conclude why shares could achieve decent returns, but not enough to get us involved

Why Seagate is investable

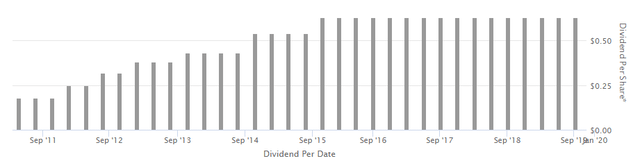

Our core thesis on why Seagate could be an investable opportunity is because its shareholder return policy has allowed for relatively consistent returns, despite the company's cyclical business model. Over the past decade, the company has been consistently paying quarterly dividends, which have been growing when possible.

Source: Seeking Alpha

Source: Seeking Alpha

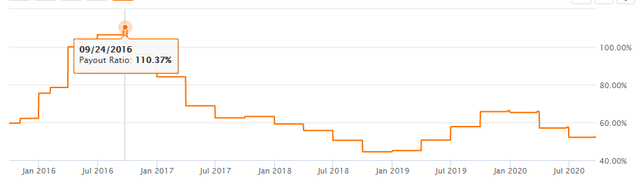

Management has been prudent with the company's dividend policy. As we mentioned, Seagate's profitability can see significant fluctuations. Despite DPS being stable over the past few years, the payout ratio reached worrying levels in 2016. We believe this is a thoughtful strategy by management since DPS should remain relatively covered if another EPS decay occurs.

Source: Seeking Alpha

Coupled with the dividend, the company delivers further tangible returns through its stock repurchase programs. We believe this is an excellent way to return capital to shareholders