Welcome to the not rallying along edition of Natural Gas Daily!

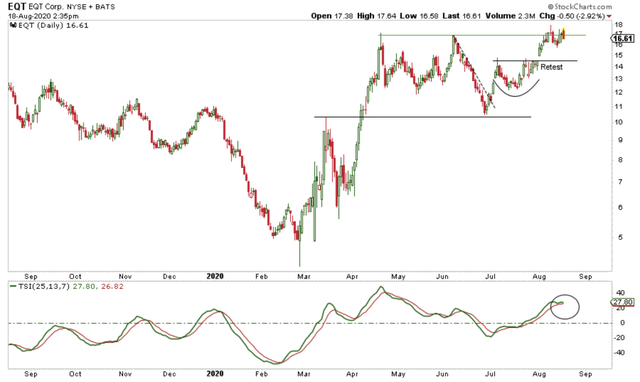

Although natural gas prices continue to march higher with September contracts hitting an intraday high of $2.465/MMBtu, natural gas producers have not followed suit. In fact, our favorite natural gas producer, EQT, has managed to fail to breakout above $17 for over 2-weeks now.

Repeated failed breakouts usually lead to a move lower, and so after the DGAZ shenanigan is over on Thursday, we could be looking to short EQT to trade the downside on NG.

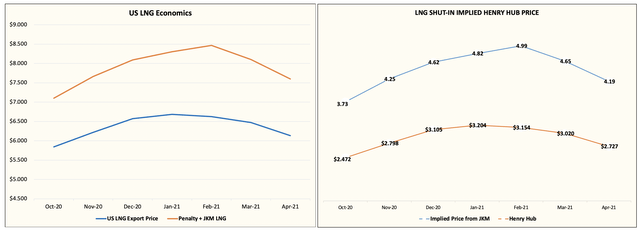

Fundamentally speaking, natural gas market has not exactly tightened in the last week or so to justify this move. One could argue that the LNG price ramp globally justifies Henry Hub to catch-up, but we would argue that it's for Q4 pricing, not today's prices that will benefit.

Source: CME, HFI Research

As we noted in our NGF to subscribers yesterday, there's virtually no more risk of US LNG being curtailed in Q4 thanks to much higher pricing globally. As you can see, Henry Hub would need to rise to ~$4/MMBtu to justify lower exports, and that's unlikely considering domestic storage overhang.

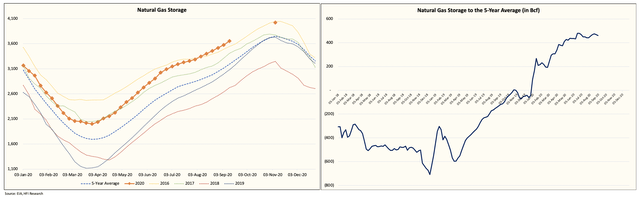

In fact, our latest update shows that the US natural gas storage situation has worsened largely due to falling cooling demand and rising production.

As you can see in our forecast above, natural gas storage is set to reach the highest level in recent years by mid-September.

So while the US storage situation presents a more troubling outlook for prices, the DGAZ unwinding remains at center stage for frenzied trading. We wrote about it in more detail last Friday. Many of the traders we survey are staying out of the market completely until the frenzy unfolds by Thursday.

And once the traders return to the fold, it's likely to the downside near

We are now offering a 2-week free trial!

For readers interested in following natural gas fundamentals, HFI Research Natural Gas premium provides:

- Daily natural gas fundamental updates.

- Weather updates.

- Energy ideas.

- Real-time natural gas trades.

For more info, please see here.