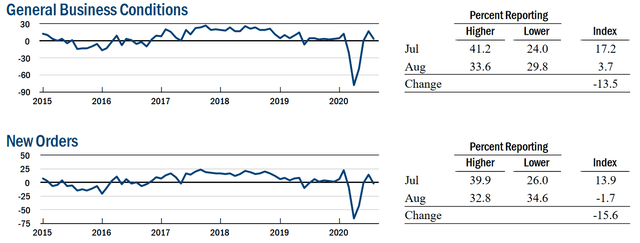

While positive, the latest New York Fed manufacturing index fell (emphasis added):

The general business conditions index fell fourteen points to 3.7. Thirty-four percent of respondents reported that conditions had improved over the month, while 30 percent reported that conditions had worsened. The new orders index fell sixteen points to -1.7, indicating that orders leveled off, and the shipments index fell twelve points to 6.7, pointing to a modest increase in shipments.

Here are two charts of the relevant data:

It appears that there was a quick bump as customers made up for lockdown-caused downtime followed by a modest cooling of activity. This should be surprising, especially as the economy continues its two steps forward, one step back pace of activity.

Homebuilders confidence hit an all-time high in the latest report (emphasis added):

In a sign that housing continues to lead the economy forward, builder confidence in the market for newly-built single-family homes increased six points to 78 in August, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. The HMI now stands at its highest reading in the 35-year history of the series, matching the record that was set in December 1998.

“The demand for new single-family homes continues to be strong, as low interest rates and a focus on the importance of housing has stoked buyer traffic to all-time highs as measured on the HMI,” said NAHB Chairman Chuck Fowke. “However, the V-shaped recovery for housing has produced a staggering increase for lumber prices, which have more than doubled since mid-April. Such cost increases could dampen momentum in the housing market this fall, despite historically low interest rates.”

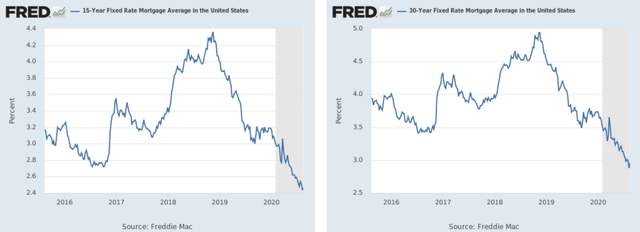

Low interest rates are probably a key reason:

15- and 30-year mortgage rates (left and right, respectively) are near 5-year lows.

The RBA released the leading meeting minutes