It's old news now - when the COVID-19 pandemic all but forced most of the United States to shut down, many safe-at-home households turned to online shopping. In turn, online shopping drove an increased usage of packaging materials and pushed higher the demand for corrugated cardboard. One may have expected packaging manufacturers to benefit. However, at least initially, the opposite occurred.

Corrugated materials are used to package and transport over 95% of the goods consumed in North America. Globally, corrugated materials account for 40% of the paper produced. One ton of new cardboard requires felling approximately three tons of trees. Fortunately for Mother Nature, approximately half of new corrugated cardboard is produced from recycled fiber.

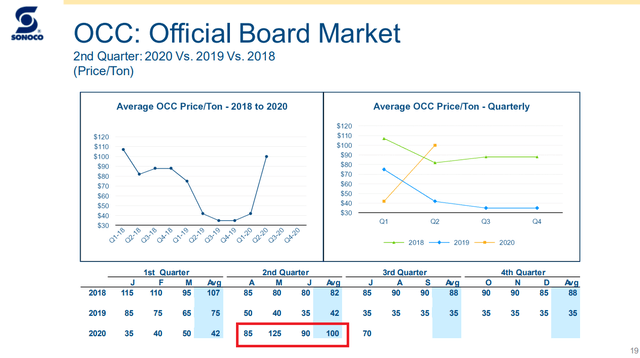

Yet, much of the used cardboard in the United States has, typically, been generated by large institutions, large retailers and restaurants – the exact businesses impacted by the COVID-19 pandemic and the shutdown. So, with business doors shuttered, the price of recycled fiber or OCC (old corrugated cardboard) rocketed higher.

The Warning

Sonoco Products (NYSE:SON) is a global diversified packaging provider. The company relies on OCC as input to its products. It warned in its 2020 first-quarter earnings call in mid-April about the upcoming dilemma.

We expect recycled fiber prices to continue to increase during the second quarter, likely reaching above $100 a ton by June, which should benefit our recycling operations but provide a significant price/cost headwind to our paper-based business during the quarter until we ultimately achieve recovery of those higher costs in the second half of the year. (emphasis added)

Of its four reporting segments, Consumer Packaging, Display & Packaging, Paper & Industrial Converted Products and Protective Solutions, Sonoco expected the greatest impact to its Industrial segment.

Moving to our price/cost expectations for the second quarter, driven by our outlook for OCC