Investment thesis

We first heard of Veeva Systems (NYSE:VEEV) 'Veeva' at our value investing meetup in London in early 2019. As the name of the meetup suggests, there was nothing that a 'growth' stock like Veeva could have done to convince our participants that the price was right. Unsurprisingly, the majority of the Q&A session revolved around valuation, a classic value investing discussion.

We can see why Veeva is the leader in cloud solutions for the global life sciences industry. They help life sciences companies develop and bring products to market faster and more efficiently, market and sell more effectively, and maintain compliance with government regulations. COVID-19 has only signified their importance to the industry as its cloud solutions allow the execution of product releases remotely.

Even with the continued political wars between the US, Veeva thrives, as the company exploited cost-cutting opportunities. The stock surges to an all-time high north of $270 per share. Valuation multiples also reach a mind-blowing 32x EV/Sales. Despite this, we are convinced that Veeva is an investment for all-weather and don't see a problem with the premium valuation today.

Undisputed market leader in life sciences and still growing rapidly

The company operates in two categories; Veeva Commercial Cloud, which entails vertically integrated customer relationship management, or CRM, services; and Veeva Vault, a horizontally integrated content, and data manager.

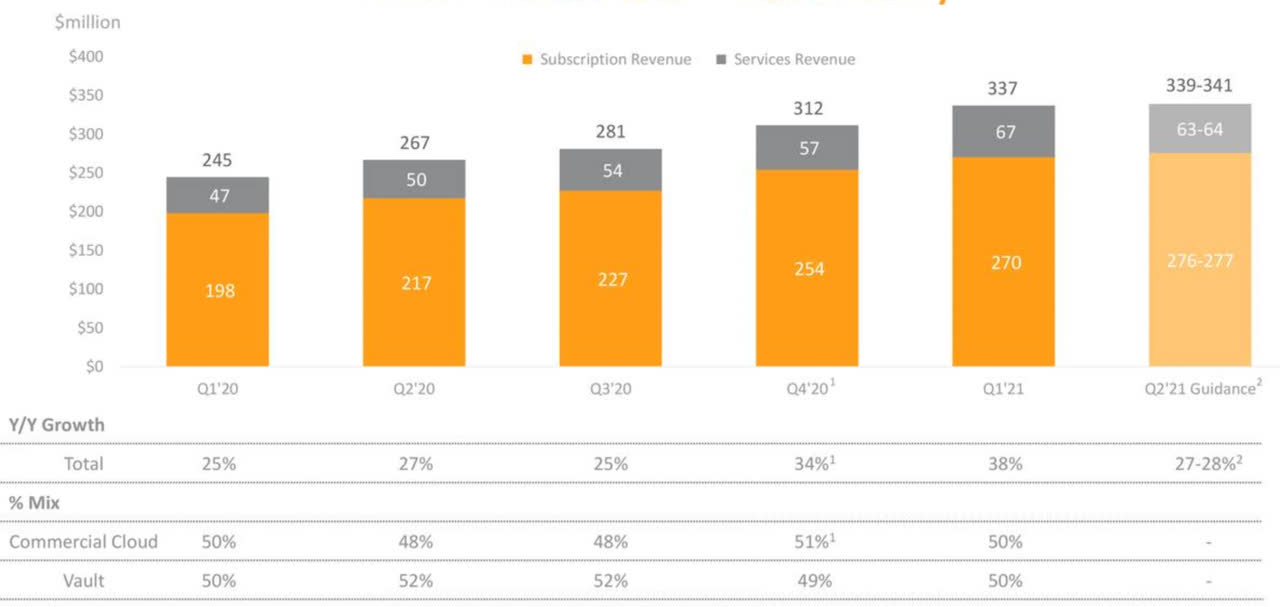

Despite owning about 40% of the total addressable market, Veeva still has ample opportunity to penetrate a highly fragmented market further. Veeva posted incredible YOY growth in Q4'2020. Q1'2021 was even more impressive. We expected around 20%, but they almost doubled that.

Source: VEEV Q1'2021

Q1'2020 figures:

Total revenue was $337 million up 38% year-over-year. Subscription revenue grew 36% year-over-year. Non-GAAP operating margin was 39%.

These impressive numbers confirm the rapid adoption of new modules, and further