Interest rates have hit 0% and stocks have become overpriced and somewhat unreliable for income investors.

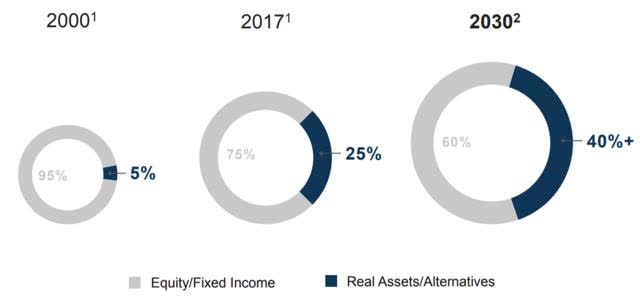

It's forcing investors all around the world to reconsider their asset allocation and adapt their portfolio for this new yieldless world.

And where are all these investors expected to seek refuge?

The answer is real assets. Think about commercial real estate. Distribution centers. Windmills. Timberland. Pipelines. Railroads… Anything that's tangible and a vital part of our infrastructure:

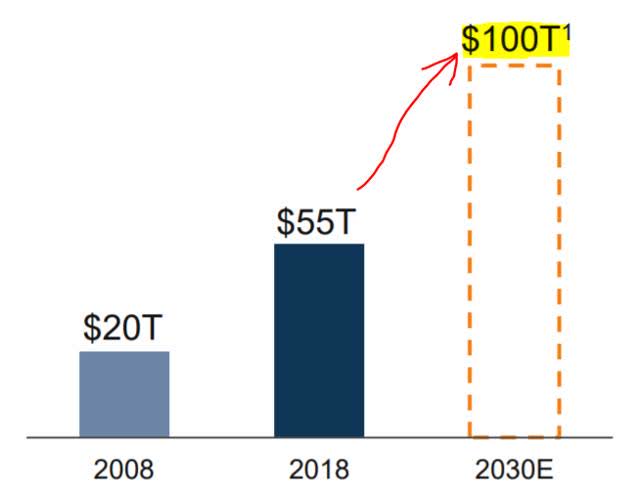

Over the coming 10 years, nearly $50 trillion is expected to shift from stocks and bonds into real asset investments:

And that’s $50 trillion with a “t.” Real assets are the only remaining investments that offer significant and reliable income in today's world, and therefore, income investors have no other options. Pension funds, insurance companies, banks, endowment funds, retirees... all will have to significantly increase their exposure to real assets in the future:

With an additional $50 trillion hitting the real asset market, how will this affect prices?

There's only a limited amount of such investments, and yet their demand is growing very rapidly. As they grow in popularity, you don’t have to be a genius to understand what will happen.

Cap rates (the inverse of valuation multiples) will compress to new all-time lows and prices will get bid up to levels never seen before. $50 trillion is a lot of capital and we expect it to change the real asset market as we know it today.

Let’s take the example of an apartment community:

This apartment community generates $100,000 in net operating income, or NOI, each year. Right now, you can buy it at a 6% cap rate, which would put the value of this property at: $1,666,666.

However, that was the appropriate valuation when you could get a 2%-3% on Treasuries. Now, Treasuries yields have

Are you Positioned to Profit from the Rush to Real Assets by Yield-starved Investors?

At High Yield Landlord, we have positioned our portfolio to thrive in today’s rapidly evolving environment. We are the #1 Ranked Service for Real Asset Investors on Seeking Alpha with over 2,000 members on board.

We spend 1000s of hours and well over $50,000 per year researching the Real Asset market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Join us Before the Price Hike!