My Friday column's first section normally uses the conceptual framework of Arthur Burns and Geoffrey Moore to present economic data. Because few economic reports were released this week, that format seems moot. However, the Federal Reserve did publish the latest meeting minutes. Since this was for the July 28-29 meeting, it provides a near-contemporaneous analysis of the US economy along with relevant anecdotal commentary. I'll use that commentary instead, peppered with relevant data from the FRED system.

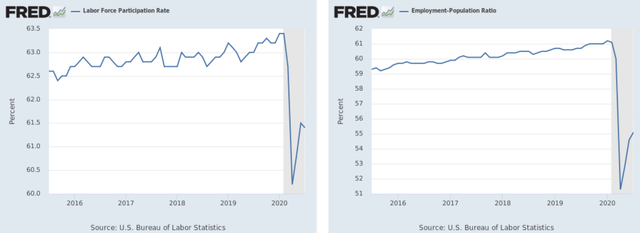

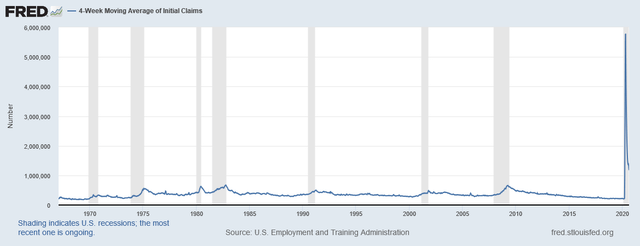

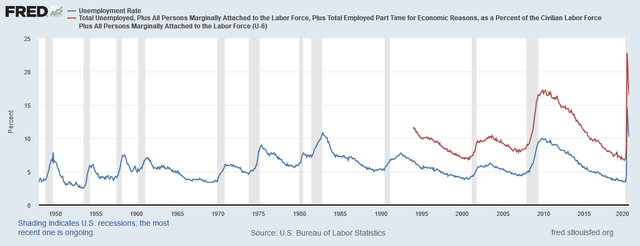

Total nonfarm payroll employment expanded robustly in June, as it did in May, but the gains in those two months offset only about one-third of the jobs lost in March and April. The unemployment rate moved down further to 11.1 percent, but it continued to be far above its level at the beginning of the year. The unemployment rates for African Americans, Asians, and Hispanics declined, on balance, over the past two months but remained well above the national average. Both the labor force participation rate and the employment-to-population ratio increased further in June. Initial claims for unemployment insurance benefits continued to decrease, on net, through the middle of July, but the pace of declines had slowed in recent weeks.

Let's start here:

Pandemic-caused losses wiped out nearly all the job gains from the expansion.

U-6 (in red) - a broader measure of unemployment - is at its highest level on record. U-3 (in blue) - the traditionally reported unemployment rate - is just below the high of the early 1980s recession.

Both the labor force participation rate (left) and employment/population ratio (right) dropped sharply. Each has rebounded somewhat, but both are still severely damaged from the pandemic.

The 4-week moving average of initial unemployment claims is still over 1,000,000 per week, which is clearly the highest level on record. This indicates that the