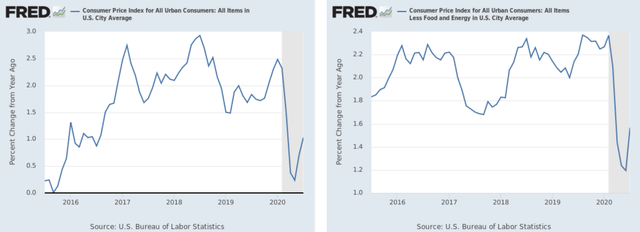

Inflation isn't an issue:

The Y/Y percentage change in total CPI (left chart) is right around 1%. Core inflation (which strips out food and energy prices) is just below 1.6%.

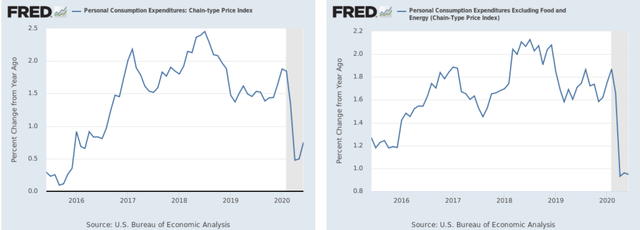

The overall PCE price index (left) is still below 1%; core PCE is right around 1% as well.

This data has two important ramifications:

- It will help to keep a bid in the bond market, since low inflation means less erosion of interest payments.

- It will support the Fed staying on the sidelines for an extended period of time.

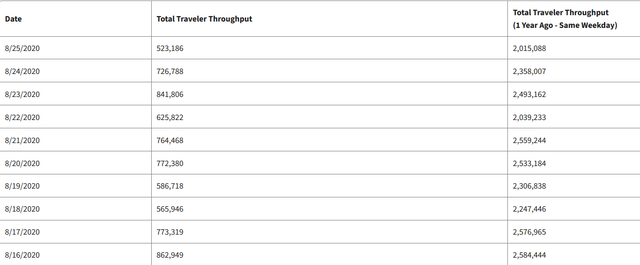

The airlines are hurting (emphasis added):

American Airlines warned employees on Tuesday that it would cut up to 19,000 workers on Oct. 1, saying that there was little sign that the pandemic-induced reluctance to travel was diminishing.

...

American is just the latest airline to predict bad news. Earlier this summer, United Airlines said that it could furlough as many as 36,000 employees in the fall. And, on Monday, Delta Air Lines warned that it might have to furlough as many as 1,941 pilots in October, even after nearly as many had accepted buyouts.

To show the drop in travel, here's a table of the last 10 days of TSA screenings:

Overall travel is still very low relative to year-ago levels.

A second question to ask is, "When will the volume of travelers return to pre-pandemic levels?" I would guess at least a year, and probably longer. Business is now realizing that video meetings are a far cheaper alternative to travel. While face-to-face interactions will never fully disappear (especially when closing a deal), expect video meetings to be used more frequently. The fact that airlines are furloughing employees indicates they see a difficult path ahead for the industry.

Durable goods orders are increasing (emphasis added):

New orders for manufactured durable goods in