This article series is designed to keep investors informed of upcoming dividend increases. Any company can increase its dividend, but these companies have a history of annual increases. For dividend growth investors, this can be an opportunity to start or add to positions prior to a new increased payout. This can be especially important for retirees who live on dividend checks.

The lists I've compiled provide various stats for the stocks that are increasing their dividends next week.

This list is a trimmed-down version only covering dividend increases. A full upcoming dividend calendar is always available here. If you know how this was built and the caveats, feel free to jump down to the lists themselves.

How It's Assembled

The information presented below was created by combining the "U.S. Dividend Champions" spreadsheet hosted here with upcoming dividend information from Nasdaq. This meshes metrics about companies with dividend growth history with upcoming dividend payments (and whether those payments are increasing). These companies all have a minimum five-year dividend growth history.

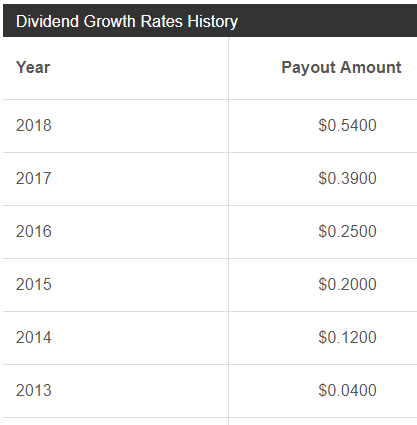

As a point of clarification, companies are included that may not raise their dividend every calendar year, but the total annual dividend received will still be higher each year. One such example is Bank of America (BAC).

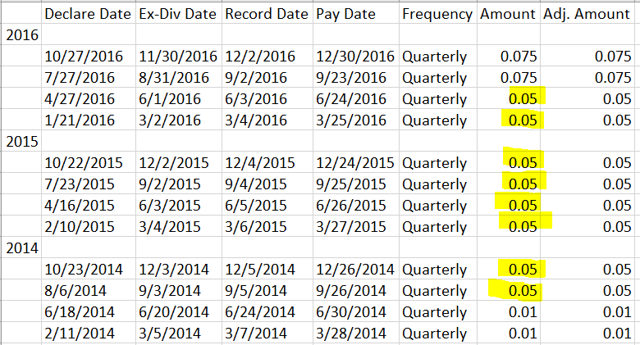

In the table here on SA, the annual dividend payout received by a shareholder increased for each year in this time frame. Thus, it is eligible for inclusion in the "CCC" list.

That said, it did pay out the same amount for eight quarters in a row, but again, the total annual amount increased each year.

What Is The Ex-Dividend Date?

The "ex-dividend" date is the date you are no longer entitled to the dividend or distribution. You need to have made your purchase by the preceding business day. If the date is a Tuesday, you need to have