Quicker recovery in the industry

The industrial activity is essential to the Brazilian economy. According to the data provided by the National Industry Confederation, it generates nearly 21% of the country's GDP.

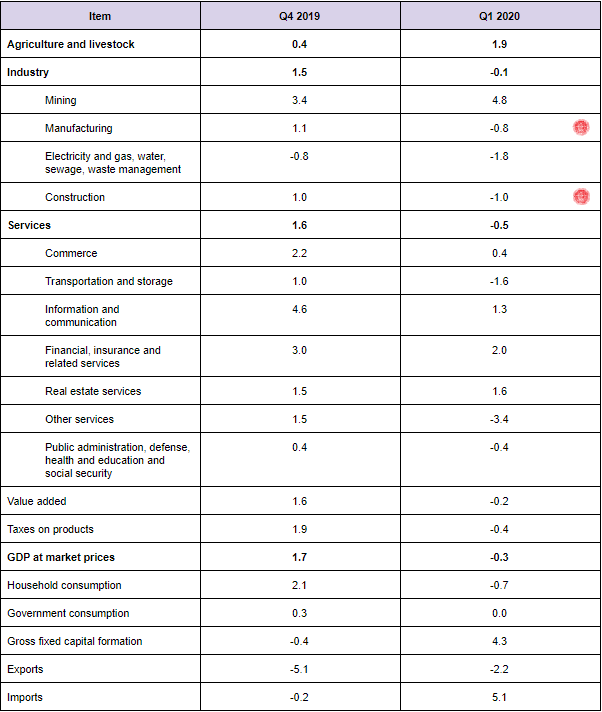

If we look at Brazil's GDP structure in the first quarter of 2020, we will see that among the industrial sectors, the manufacturing and construction sectors sagged the most compared to the fourth quarter of 2019.

Brazil GDP Annual Growth Rate, % change

Source: IBGE

Source: IBGE

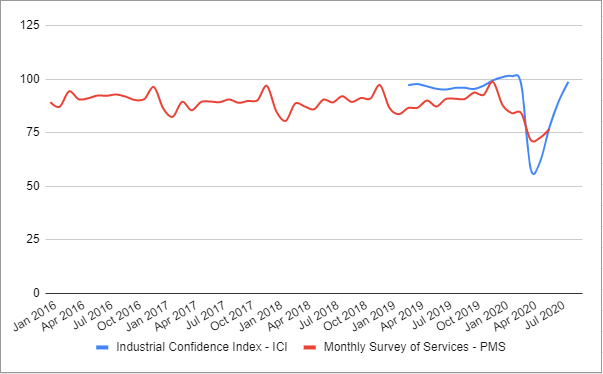

However, the data from leading indicators suggest that the industry is recovering at the moment more confidently than the service sector. According to the Getulio Vargas Foundation data, the Industrial Confidence Index (ICI) fully recovered in August to its average of 100 points, indicating the neutral business sentiment in the industry. The same report provides a reason for such sentiments:

Although they are still dissatisfied with the level of demand, the opinion of businessmen on the situation is that at the moment it has increasingly approached the pre-pandemic period.

In the service sector, the situation is worse. According to the Brazilian Institute of Geography and Statistics (IBGE), the sentiment index for services sank more significantly, and in June 2020 (the latest published data), it was still much lower than both its pre-crisis level and its average value.

The Industrial Confidence Index and Monthly Survey of Services, 2016-2020

We can suggest that since the leading indicator of the service sector did not show a sharp recovery in June-July in contrast to the industrial sector, we do not expect a sharp rebound in this segment in the third quarter. The main reason for such performance is restrictions still in force due to the coronavirus.

If we turn our attention to another significant sector of the industry - construction - then practically all sub-indices of sentiments

Source:

Source: