Yesterday, Fed Vice Chair Clarida added further clarification to the Fed's new mandate. Regarding inflation, he noted that the Fed's previous 2% goal was taken to mean that once inflation hit 2%, the Fed would raise rates. This effectively lowered inflation expectations, which, in turn, lowered overall inflation. By targeting an inflation average, the Fed is implying that it will let inflation run above 2% to counter the period of low rates. This will raise the public's inflation expectations, which will (hopefully) help to prevent a period of dwindling price pressures a la Japan. Whether this works or not is anybody's guess.

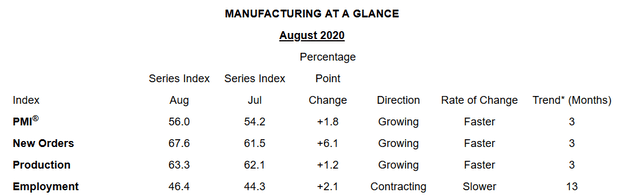

ISM released the latest manufacturing index:

All numbers are very strong, save for the employment data. Most anecdotal comments are strong (emphasis added):

- "Watching COVID-19 situations in Mexico, Brazil, Philippines [and] Hong Kong. High rates of COVID-19 surging. Currently, lines of supply no longer impacted by COVID-19 related events." (Computer & Electronic Products)

- "Business is very good. Production cannot keep up with demand. Some upstream supply chains are starting to have issues with raw material and/or transportation availability." (Chemical Products)

- "Airline industry continues to be under great pressure." (Transportation Equipment)

- "Current sales to domestic markets are substantially stronger than forecasted. We expected a recession, but it did not turn out that way. Retail and trade customer markets are very strong and driving shortages in raw material suppliers, increasing supplier orders." (Fabricated Metal Products)

- "Homebuilder business continues to be robust, with month-over-month gains continuing since May. Business remains favorable and will only be held back by supply issues across the entire industry." (Wood Products)

- "We are seeing solid month-over-month order improvement in all manufacturing sectors such as electrical, auto and industrial goods. Looking to add a few factory operators." (Plastics & Rubber Products)

- "Rolling production