Co-written with Philip Mause

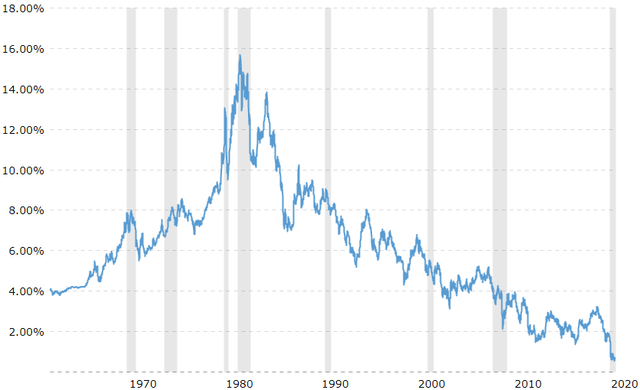

Unprecedented Low Rates

Interest rates have fallen to levels never seen before in America in recorded financial history. While the short-term rate on Treasury bills got to similar levels at various times in the last 10 years, the 10-year rate has hit levels never seen before. Even in the Great Depression, even after the fall of France in 1940, and after Pearl Harbor in 1941, the 10-year rate never got this low. In the wake of the 2008 Panic, the 10-year rate got down in the 1.5% range but never close to the current 0.6% levels. 30-year rates are also breaking records. Below is a chart of the 10-year treasury yield for the past 54 years.

Source: MacroTrends

Federal Reserve Chairman Powell has recently made it clear that these rates will persist for a long time and that the Fed will enter the market and, if necessary, expand its balance sheet in order to keep both short and long rates low. The new Fed policy will be more tolerant of inflation so that we will not likely see rate increases even when inflation goes above 2%. Barron's has quoted one analyst who does not expect the Fed to raise the federal funds rate before late 2024.

These low rates have bled into the corporate and municipal bond markets. Municipal bonds are trading at very low yields despite significant challenges to state and local government finances (and, therefore, default risks) created by the coronavirus. Corporations are issuing bonds that yield less than 1% and the Barron's list of "high yield" bonds currently includes several bonds yielding considerably less than 3% and none yielding more than 7%.

The Plight of Fixed Income Investors

Fixed income investors looking in the rear view mirror may feel a sense of

High Dividend Opportunities, #1 Dividends Income

HDO is the largest and most exciting community of income investors and retirees with over +4400 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!