Amarin (NASDAQ:AMRN) is substantially de-risked at its current price well under $5/share after losing its appeal.

Figure 1: Amarin Stock Chart (source: finviz)

Amarin’s market cap is about $1.66 billion now, but the company reported having $611.3 million in cash and equivalents on hand at the end of Q2. Unlike with many biopharmas where cash shouldn’t be fully counted due to a high cash burn rate, Amarin’s net loss for the first half of 2020 was just $16.1 million. Add to that the fact that Amarin is likely to be cash-flow positive in the second half of 2020 and you have well over a third of the current market cap supported by the company’s cash balance.

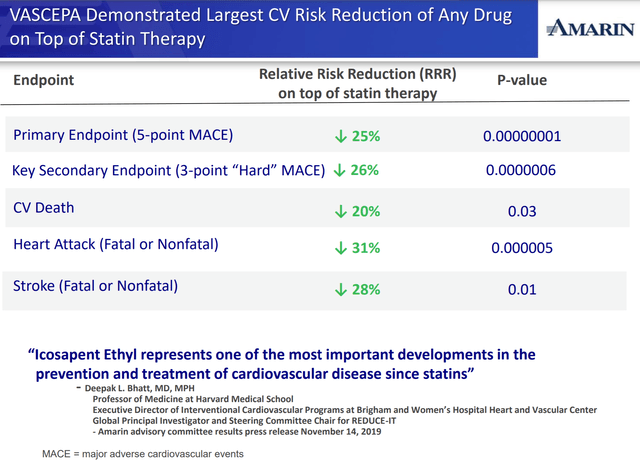

We’re also talking about what will likely be a hugely successful drug. Vascepa is now the most effective approved therapy for what is often referred to as residual cardiovascular risk, that is the risk of cardiovascular events that remains even after a patient’s LDL-C is controlled, usually via statins.

Figure 2: Vascepa’s Efficacy On Top Of Statins (source: Amarin’s September 2, 2020, Investor Presentation)

Based on the label expansion into this residual risk area, the potential market for Vascepa has tremendously increased. Amarin estimates that more than 56 million people in the US could now benefit from using Vascepa, with 12 million already on statins and 44 million+ that are either statin-intolerant or statin refusers.

Amarin Will Likely Still Be Very Profitable In The US Even With Generic Competition

Even with the launch of generics, Amarin will likely still make money on Vascepa in the US. If even 10% of the people that in Amarin’s view would benefit from taking Vascepa end up on the drug, that would be over 67 million total Vascepa prescriptions per year at maximum market penetration. That number seems realistic, and maybe even conservative, given that