The strong capital gains over the last few months in the CEF market are unlikely to be repeated. This means that to generate alpha income investors will need to rely more on alpha generation strategies. One such popular strategy is dividend capture. There are two reasons why the CEF population may be potentially attractive for dividend capture strategies. First, the CEF market is relatively inefficient in large part owing to its small size which means it does not attract a lot of smart institutional money. And secondly, the CEF population looks like an attractive target because of the tendency to pay larger dividends and do so monthly.

A dividend capture strategy is an income-focused short-term trading strategy designed to hold securities only for long enough to capture their dividends. At its most basic the investor purchases the shares prior to the ex-dividend date and sell the shares on or after this date. There is no reason to hold the security till its record or pay date.

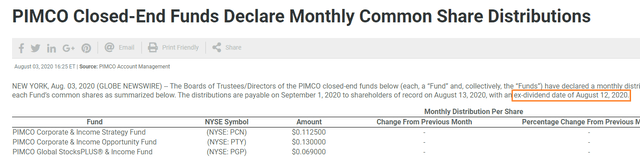

The key question for investors pursuing a dividend capture strategy is what the ex-dividend date of a given fund is. This date can vary month to month and is typically announced by the fund in a release or on its website prior to the fact. For example, this is what the PIMCO release looks like. Aggregator sites like CEFConnect also publish these dates.

Source: PR Newswire

When thinking about executing the dividend capture strategy there are a number of considerations. First is the technical buying and selling pressure from other investors who are pursuing the strategy. The selling pressure is likely to be the highest on the ex-dividend date and should subside in subsequent days. Stacked against this is the market risk element. The longer the investor holds the fund out of the ex-div

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the closed-end fund, open-end fund, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!