Investment Thesis

DocuSign (NASDAQ:DOCU) trades for 22x sales its CY2021/FY2022. And while this appears on the surface to be an exorbitant valuation, there are reasons why this valuation is justified.

In fact, this rapidly growing SaaS stock still has more upside potential ahead, despite the recent tech sell-off causing investor trepidation.

DocuSign continues to guide for rapid growth rates, with a Rule of 40 for Q2 2021 above 50%. This stock is worthwhile considering.

DocuSign: Into The Storm

After the tech sell-off that we witnessed last week, many readers may question whether I have not lost my value approach by being bullish DocuSign at this valuation.

There's no doubt that its valuation doesn't come cheap (more on this later), but in an environment where many companies are struggling with either visibility or growth or even both, DocuSign still eyes up strong growth rates and impressive visibility.

DocuSign is an e-signature platform. Its value proposition is on making agreement signing quick and painless in a digital world. When customers need to sign consent forms or deeds, DocuSign aims to service this need online.

Furthermore, during the quarter, the company made a small acquisition of $38 million, using its stock, of Liveoak Technologies. Liveoak is a company focused on video identity verification, which gives DocuSign a footing into employing video conferencing as a way to create a detailed audit trail.

But what's particularly attractive about DocuSign is its growth rates.

Growth Rates Are Strong and Steady

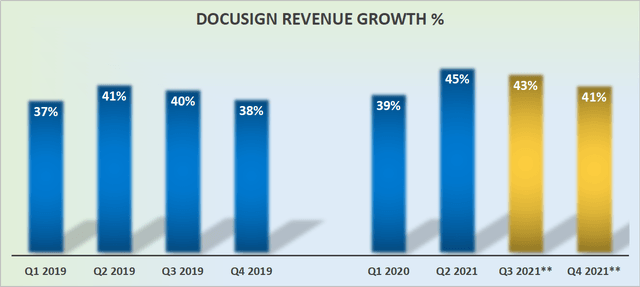

As you can see below, the company's growth rates are impressively strong and steady:

Source: Author's calculations, **low-end company guidance

In fact, one of the most compelling aspects of this rapid growth story is just how tight the range in its outlook for full-year revenues are at $1.386 billion at its midpoint, but with a range of just $4 million

Strong Investment Potential

Investing is about growing savings and avoiding risky investments. My Marketplace highlights a strong selection of hugely undervalued investment opportunities.

Stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

Investing Made Very EASY

I do the hard work of finding a select group of stocks that grow your savings.

- Honest and reliable service.

- Hand-holding service provided.

- Very simply explained stock picks. Helping you get the most out of investing.

- Helpful advice together with videos.