GoPro's (NASDAQ:GPRO) valuation has largely absorbed the demand-side weakness driven by COVID-19. GoPro's growth and margins guidance are supported by flexible sales conversion/growth options including new products, features, and use cases. These trends will drive growth and margin outperformance heading into 2021. GoPro has improved its value proposition as a top action camera. Besides the product updates, GoPro appears to have a better handle on its cost buckets. More website-driven revenue means better visibility in accounts receivable. Improving earnings contribution to operating cash flow is important to build well-rounded valuation factors. GoPro appears to be on the right path.

Source: Amazon

The demand for GoPro's offerings has been impacted by the global pandemic. This led to GoPro's strategy shift to optimize for margins and customer lifetime value. Since retail-driven sales have been impacted by fewer offline shoppers buying non-essential items, GoPro has shifted to targeting users via its website. A direct to customer sales strategy also offers GoPro the opportunity to cross-sell customers before checking out their online shopping cart. What more, GoPro is also growing its subscription service to drive customer retention. This service includes discounts for camera accessories, unlimited cloud storage for photos downloaded to the GoPro app, and camera replacement options. GoPro recently surpassed 400k Plus subscribers. This number is projected to grow to 700k subscribers by the end of the year. Achieving this number depends on GoPro's ability to understand its users' needs.

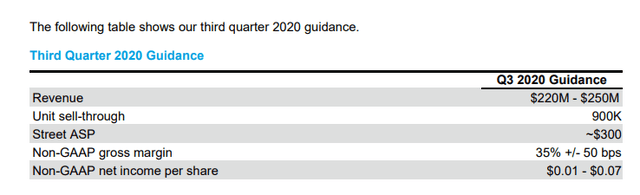

Source: GoPro

Using digital marketing to drive customers is good as the saved T&E expenses are rotated to online ad campaigns. GoPro also highlighted website A/B tests and other experiments to drive customer satisfaction on its web assets. This strategy is compelling and it demonstrates better visibility into lead conversion heading into the holiday season. As it stands, the macro trend of customers using their smartphone camera