Most investors invest the majority of their capital into regular stocks and bonds.

I prefer to invest most of my capital into real assets investments, which include REITs, MLPs, YieldCos, and other Infrastructure companies.

And in this article, I will outline why I expect real assets to soar in the recovery and outperform regular stocks and bonds.

Without further ado, here are the 5 main reasons why you should consider a large allocation to real assets today:

Reason #1 – Defensive Cash Flow for a Slow Recovery

It appears increasingly likely to us that the economic recovery will be long and slow. As we explain in a recent Market Update at High Yield Landlord:

Three issues will prevent a quick snapback in the economy and will instead cause the recovery to be slow and halting for a long time to come:

- The coronavirus itself, which is killing people (i.e. workers and consumers), reducing (or reducing the efficiency of) work hours, and diverting resources away from productive purposes.

- Government responses to the coronavirus pandemic, which, whether beneficial on net or not, have undoubtedly had a dampening effect on the economy by restricting business operations.

- The major increase in national debt incurred because of the crisis.

The Fed itself does not expect a full recovery for quite some time and this is also why interest rates are expected to stay at near 0% for years to come.

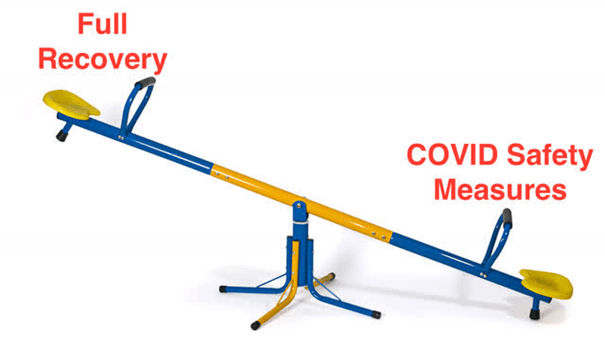

You just cannot have it all: a full recovery and strong covid safety measures. It is one or the other:

With the economic recovery taking much longer than previously thought, investors should position their portfolio for slower growth by focusing on investments that enjoy:

- Long contractual cash flow

- An essential nature

- A high cash flow yield

And that’s exactly what real

Are you Positioned to Profit from the Rush to Real Assets by Yield-starved Investors?

At High Yield Landlord, we have positioned our portfolio to thrive in today’s rapidly evolving environment. We are the #1 Ranked Service for Real Asset Investors on Seeking Alpha with over 2,000 members on board.

We spend 1000s of hours and well over $50,000 per year researching the Real Asset market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Join us Before the Price Hike!

SIGN UP HERE FOR 2-WEEK FREE TRIAL