Big companies have small moves, small companies have big moves. - Peter Lynch

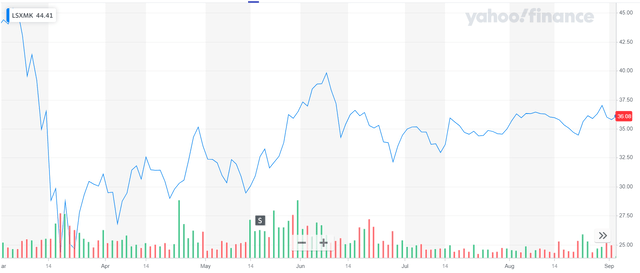

As we continue to see more good news each day about re-openings, one way to gain exposure is by buying The Liberty SiriusXM Group (LSXMK). The stock bottomed in March and has yet to recover to pre-pandemic levels, presenting a buying opportunity. LSXMK is a diversified communications company with holdings in multiple areas that will benefit from movements back to re-openings, yet the stock is lagging the broader market, and has traded in a narrow range since mid-June as shown below.

LSXMK’s holdings are anchored by ownership in satellite radio company SiriusXM Satellite Radio. Sirius XM (SIRI) and its subsidiary Pandora, the largest ad-supported audio entertainment streaming service in the U.S., reach over 100 million people each month. Listeners have multiple options for accessing the services, including at home and in vehicles. The recently announced acquisition of Stitcher will increase the company’s exposure to the fast-growing podcast sector.

Stable radio signal plays on

In the midst of changing consumer preferences, Sirius XM shows stability with second quarter 2020 Adjusted EBITDA roughly unchanged at $615 million. Sirius XM reported net subscriber additions of 264,000 in the quarter as well as an improved churn. Pandora reported a year-over-year increase of 2.4% in average monthly listening hours per active ad-supported use for the second quarter.

Sirius XM resumed share repurchases in April and accessed the debt markets in June, both positive signs. The entire $1.75 billion revolving credit facility was undrawn and available at the end of the second quarter. Sirius XM ended the quarter with net debt to trailing 12-month adjusted EBITDA of 3.0x.

Additional signs of strength are in the company’s full-year guidance, which calls for Sirius XM to be free cash flow positive in 2020. For the full year, Sirius

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.