While the S&P 500 is now within just 5.5% of its all-time highs, it may seem like everything is back to normal. This, however, cannot be further from the truth, as some sectors have benefitted from the recovery much more than others. In this article, I’m focused on the leading advertising company WPP Plc (NYSE:WPP), which remains well below its trading level from earlier this year, and evaluate whether it presents an attractive investment. So, let’s get started.

(Source: Company website)

A Look Into WPP

WPP is the largest of the “Big 5” advertising conglomerates with a global presence in 112 countries and 107K employees. Over 70% of its business comes from developed markets, and in 2019, the company generated over $17 billion in total revenue.

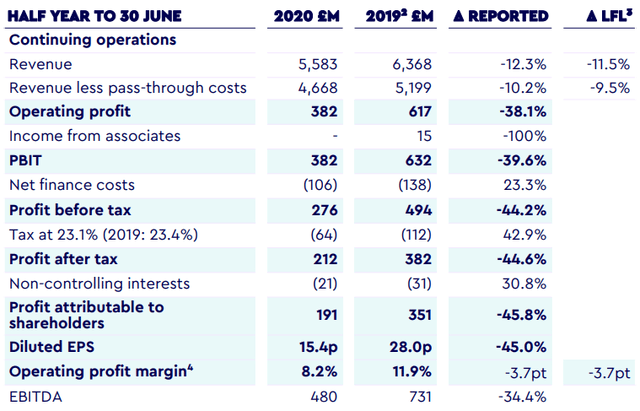

Like for other advertising agencies, COVID-19 and the ensuing recession has presented risks and challenges to WPP’s underlying businesses. This was evident by the 9.5% YoY drop in net revenues that the company saw during the first half of 2020. Diluted EPS dropped even more, with a 45% YoY decline, due to restructuring and transformation costs.

(Source: August Investor Presentation)

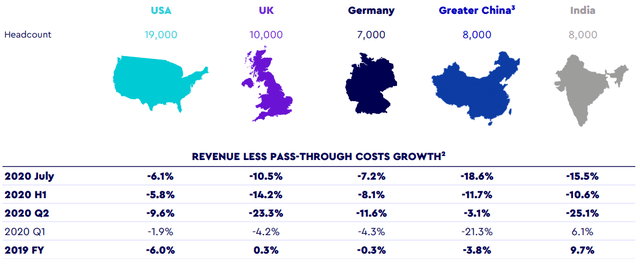

The declines can be attributed to all geographies in which the companies operate. As seen below, the UK and India regions were among the hardest hit during the second quarter. What’s encouraging, however, is that 4 out of the top 5 markets have seen a relative improvement in July.

(Source: August Investor Presentation)

While Greater China saw a larger YoY decline in July compared to Q2, management attributed the decline to a tough comparable from 2019 and expressed optimism, as noted during the last conference call:

“Coming on now to Greater China, slightly unusual figures here. So, obviously, China itself was impacted by the impact of COVID-19 earlier than any of our other global markets, and you see that