Investment thesis

HealthEquity (NASDAQ:HQY) is a technology, finance, and healthcare company, all-in-one. The company runs like a wealth management fund where users top up their money (and employer matching) into a saving account that they can use to pay for their healthcare bills in a tax-efficient manner.

Our thesis is simple. HealthEquity generates revenue through growing users' saving accounts. Therefore, as long as people (and employers) keep putting away some money for their healthcare bills, HealthEquity benefits.

As a comforting point to note, last year, HealthEquity acquired its competitor, WageWorks, allowing it to gain dominant market share instantly. Furthermore, the market is still in the early innings of growth. Thus, we are convinced that HealthEquity will be able to capture the tremendous growth that the market has to offer.

Excellent Q2 FY2020 results

Financial metrics

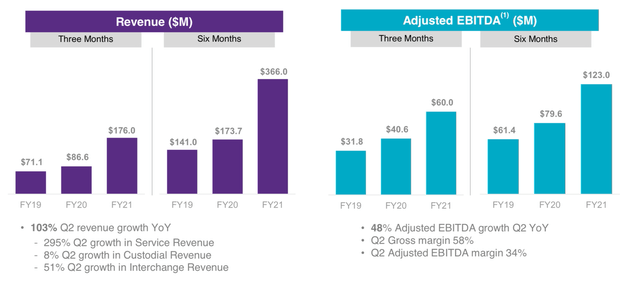

- Revenue was $176.0 million, an increase of 103% compared to $86.6 million in Q2 FY19.

- Gross profit was $101.7M, gross margin of 58%.

- Net profit was $9M, net margin of 5%.

- Adjusted EBITDA was $60.0 million, an increase of 48% compared to $40.6 million in Q2 FY19.

Operation metrics

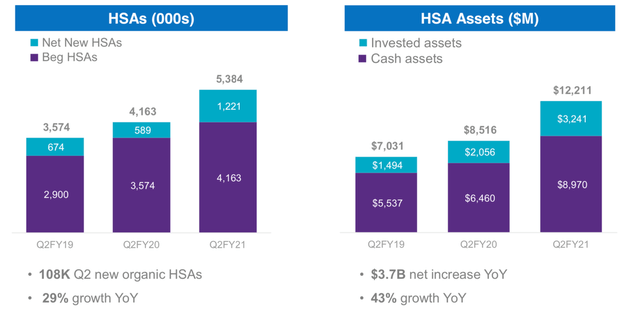

- 5.4 million HSAs, an increase of 29% compared to Q2 FY19. (13% organic growth excluding WageWorks)

- $12.2 billion Total HSA Assets, an increase of 43% compared to Q2 FY19. (25% organic growth excluding WageWorks)

- 12.5 million Total Accounts, including both HSAs and complementary consumer-directed benefit ("CDB") accounts, an increase of 158% compared to Q2 FY19.

Overall, HealthEquity delivered solid top and bottom-line results. Revenue was up 103%, and Adjusted EBITDA was up 48%. Meanwhile, gross and net margins remained stable at 58% and 5%. Considering we are in a low-interest-rate environment, these numbers show great promise for even bigger future profitability.

What is more impressive is that even during the darkest day