Utility stocks are generally a place where investors go to hide during periods of market turmoil. Their reliable cash flows and dividend payments typically make them safer choices in periods of selling for the broader market. That’s great, but during a raging bull market, like what we’ve seen since March, utility stocks are typically quite out of favor.

One such example is Essential Utilities (NYSE:WTRG), a water and gas utility that operates in Texas, as well as portions of the Northeast and Midwest.

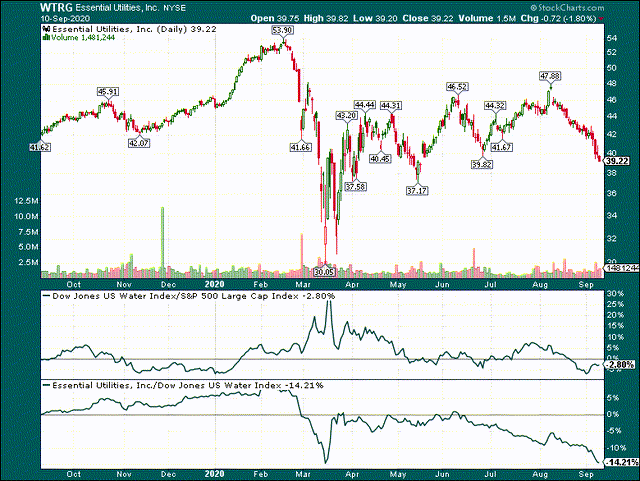

The stock was crushed during the initial panic but rebounded very quickly. The rally from the bottom to the mid-$40s was swift, but since that time, Essential has oscillated around that point. The good news is that shares have been extremely weak in recent weeks, and it looks like a buying opportunity.

Growth by acquisition

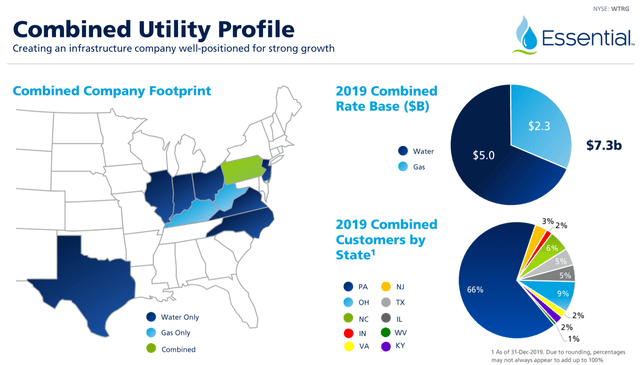

If Essential is known for one thing, it is acquisitions. The company has been acquiring utilities and customers for years and as a result, has the footprint you see below.

Source: Investor presentation

Pennsylvania remains its home, and it has a much higher concentration on water than gas, but it has been working to diversify geographically and through its service offerings. Essential is a huge utility as a result of these acquisitions, as well as rate base growth, with a rate base well in excess of $7 billion.

Source: Investor presentation

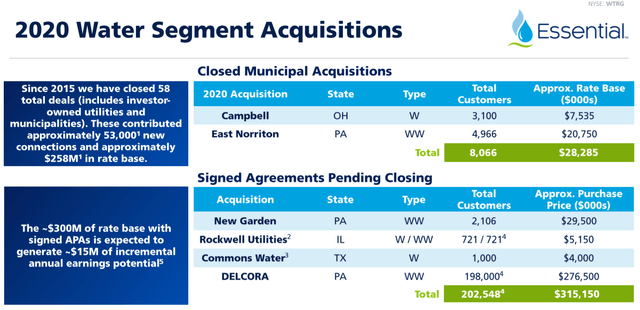

The company continues to execute on this strategy, closing the above transactions recently, while still having a robust pipeline of rate base expansion as seen below.

Source: Investor presentation

I won’t belabor the point but these numerous small acquisitions over time, as well as large ones like DELCORA, help scale Essential’s business infinitely more quickly than it could on its own. Acquisitions are expensive and cost even more money to integrate, but the