Essex Property Trust (NYSE:ESS) has seen its growth thesis called into question. With shares trading at a compelling yield relative to the market, something that seemingly hasn’t happened for many years, it is clear that Wall Street is skeptical of apartment REITs coming out of the pandemic. I think the fears are overblown and nearsighted. While ESS has indeed seen significant financial fallout as a result of the pandemic, my view is that much of the struggles will prove to be correctable in the long term. With shares yielding nearly 4%, I rate shares a buy.

Freefall or Bottom?

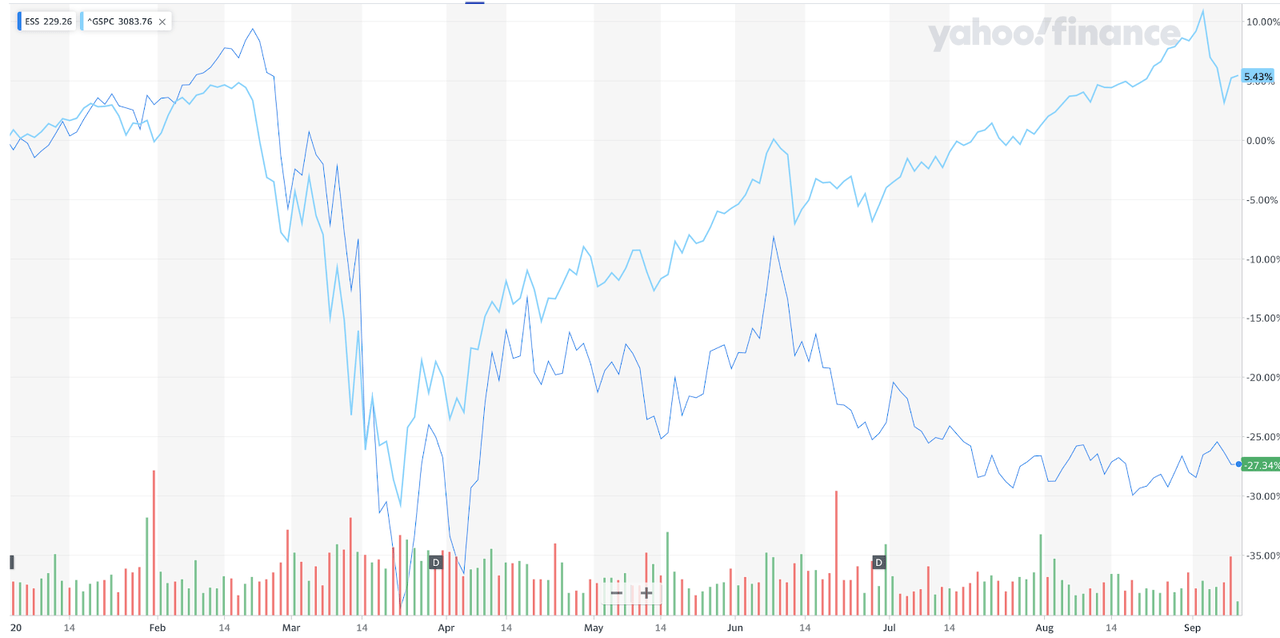

When COVID-19 hit in March, ESS fell along with the broader market. The market has come back. ESS has not.

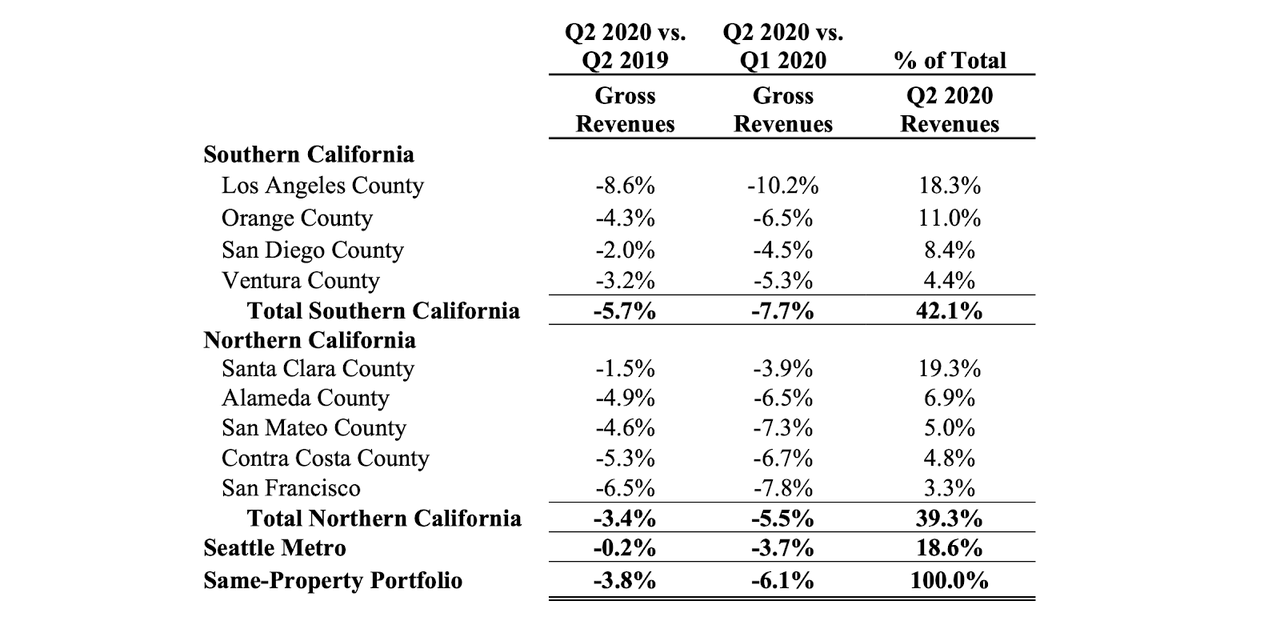

When you look at the financial results, the differing performance seems justified. In the latest quarter, ESS saw core FFO of $3.16 per share represent a decline of 5.1% year over year (‘YOY’). This came as ESS saw comparable revenues decline 3.8% YOY:

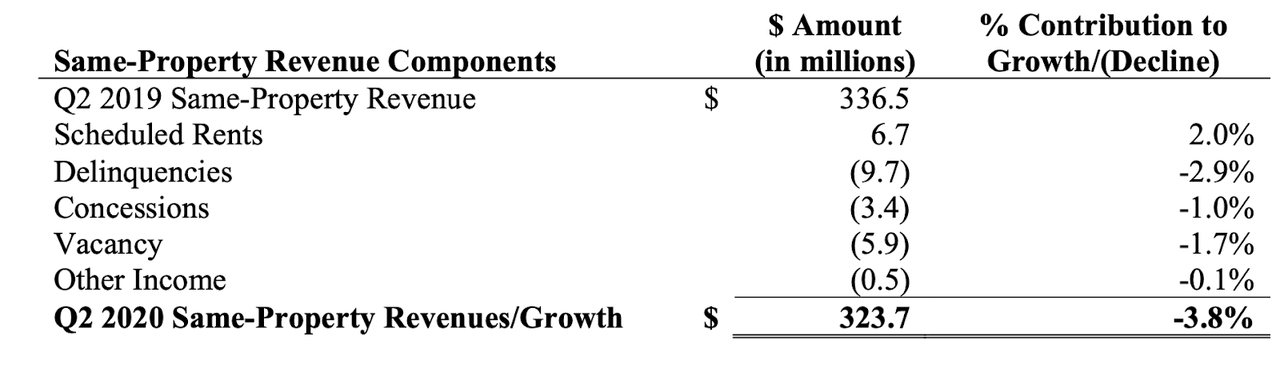

The financial weakness was offset by increased average rent, but unpaid rent, vacancies, and concessions weighed heavier on results:

Is this the beginning of the end? Are apartment rents about to fall through the floor?

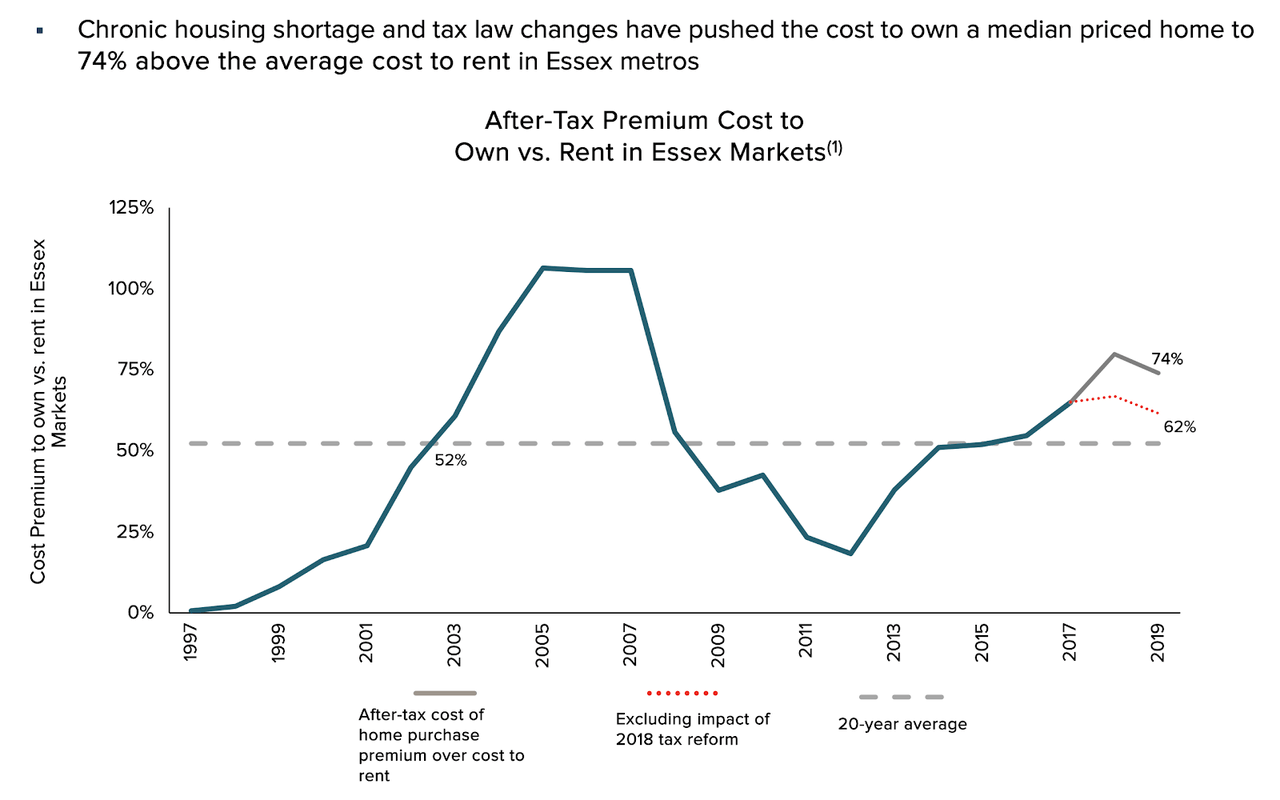

I bet many won’t mind if their cost of living came down significantly. I don’t think we should extrapolate this year’s performance over the long term. ESS’s presence on the West Coast may have hurt it in the near term due to the extensive eviction moratoriums given by the local governments. However, there is little evidence of any reduction in real estate prices in these markets. As a result, ESS’ properties are likely to remain in high demand, as the cost to own is approximately 74% higher than the cost to rent:

Perhaps

Discover More High Conviction Ideas

Apartment REITs are one of my 8 high conviction ideas. Subscribers to Best of Breed to get access to my top 10 holdings and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, new compelling ideas, and high conviction picks.

Avoid the noise. Avoid the bubbles. Stick to high quality and buy Best of Breed.