10 Undervalued Stocks With Great Potential

For this top 10 list, I wrote a search algorithm that looked for stocks with the following characteristics:

- Low or fair valuations

- Above-average quality ratings

- High and stable growth prospects

- Strong financial health

- High consensus ratings from the Wall Street analyst community

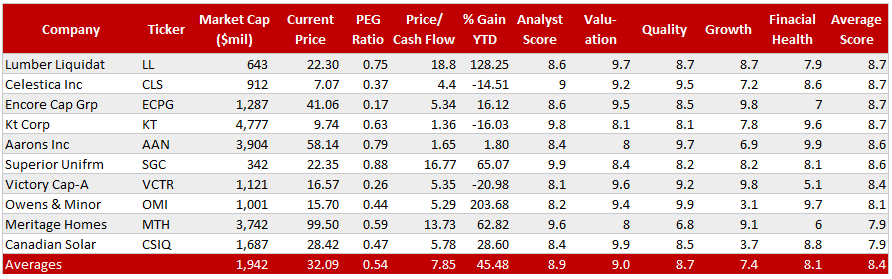

The algorithm found 72 names that qualified. I then pared the list down to the 10 names that scored the highest on all of the above listed characteristics. The results are shown in the table below.

Year-to-date charts for all 10 stocks with their 200-day moving averages

Lumber Liquidators (LL), the #1 stock on this list, has a chequered past. According to the L.A. Times:

"Lumber Liquidators, one of largest flooring retailers in the country, has agreed to pay a $33-million penalty for misleading investors about formaldehyde-laced laminate flooring from China.

The investigation and agreement with federal prosecutors in the Eastern District of Virginia stemmed from a 2015 '60 Minutes' investigation finding high levels of formaldehyde in Lumber Liquidators' laminate flooring."

Maybe this is why LL is still so undervalued. Has it gotten its act together? Analysts think it has. I'm not totally convinced, but I'm starting to warm up to the rehabilitation story.

As the chart below shows, LL made a bottom at $4 per share on March 15 and has been on a tear ever since. It peaked at $28 in August and now changes hands at $22.30. Traders who were lucky or prescient enough to step in and buy this name in mid-March are sitting on a 5-bagger. Unless they sold it on the way up, of course.

How can a 5-bagger still be undervalued? Because $4 was priced for bankruptcy, but this is a turnaround story.

Celestica Inc. (CLS), the #2 stock on the list, provides hardware platform

Check out my Factor-Based trading strategy service - The ZenInvestor Top 7.