When we last covered CVS Health Corporation (NYSE:CVS), we had a firm conviction that the shares had already delivered the bulk of the possible returns in the near term and it was time to move to sidelines. Specifically, we noted:

CVS has reached what we think is a solid fair value for the company. We anticipate another $5.0 billion of debt payments in 2020 and think the equity will again deliver a 1.5X multiplier on it. As such, we put our 2020 year-end fair value at $80/share. The key downside risk here is that the retail segment margins move closer to that of WBA. In addition, we still see risks related to the Aetna acquisition, as we think the overpayment was rather massive. The bull case can materialize from here if retail margins stabilize and CVS starts delivering big synergies wherein it can differentiate itself from its competitors by virtue of it also being a healthcare benefits provider. We are skeptical on that possibility at this point. Hence, we are moving to the sidelines and downgrading this to a "Hold".

Source: CVS: Aetna Acquisition A Big Offset To Margin Pressures

The stock has since cooperated and moved substantially lower. We say cooperated, as the move lower has certainly got our attention and made us curious to reexamine the upside case.

Q2-2020 And Forward Estimates

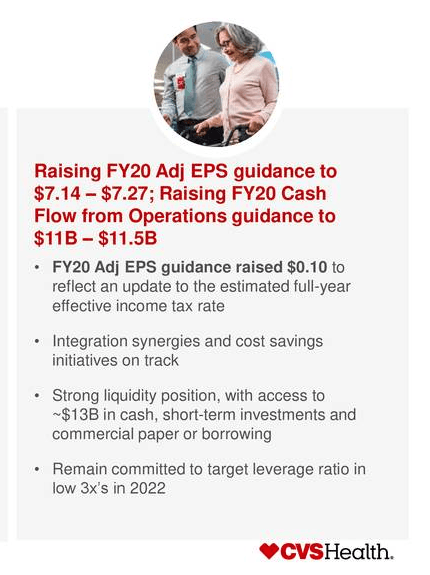

CVS raised its adjusted EPS guidance for 2020, a relative rarity in today's market. At over $7.20 in adjusted earnings, CVS is continuing to strengthen the case that we were just too pessimistic (in spite of being bullish overall) on the Aetna acquisition.

Source: Q2-2020 Earnings Presentation

Source: Q2-2020 Earnings Presentation

Interestingly, instead of hurting CVS, the pandemic helped it as it had a very low benefit payout ratio on the insurance side. This was driven by deferral of many procedures during

.