Eldorado Gold: Undervalued With Production Upside

Eldorado Gold (NYSE:EGO) is a mid-tier gold miner with a $1.9 billion market cap, which has guided for 2020 gold production of 520,000-550,000 ounces at $850-$950 all-in sustaining costs. Eldorado has four producing mines, located in Canada, Turkey, and Greece, and several development projects in Romania and Brazil.

As of writing, Eldorado shares are looking very attractive as its stock trades at a discount compared to peers. This is a low-cost gold miner with long-life gold assets, and it is highly profitable, while the market is essentially placing zero value on one of its core development projects.

I've broken down the investment case for Eldorado Gold, including an analysis of its recent financial results and what to expect in H2 2020, upside from its Skouries project in Greece and other development projects, and its current valuation.

Eldorado's Q2 2020 Financial Results

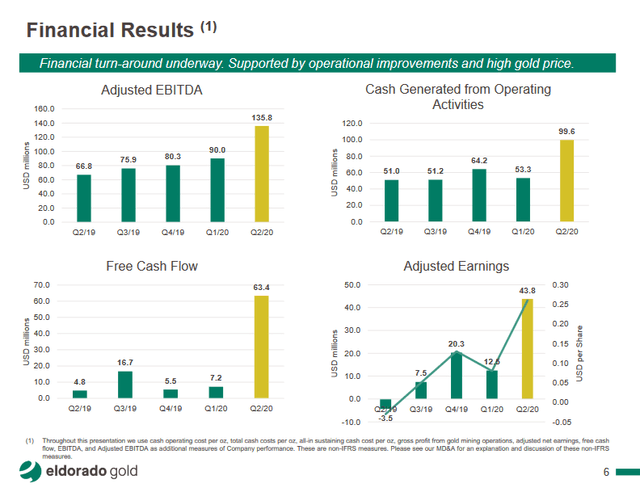

(Information on Eldorado's improved financial results. Credit: Eldorado Gold)

Eldorado is highly profitable in the current gold environment as its production and low operating costs allow it to produce strong cash flow and earnings. Its Kisladag, Lamaque, Efemcukuru mines are all strong assets producing profits in Q2.

We saw this in Q2 2020 when the miner reported the following results:

- 137,782 ounces of gold production, a 19% increase from Q1 2020.

- All-in sustaining cost of $859/oz, down from $917/oz in Q2 2019.

- Revenue of $255.9 million, operating cash flow of $99.6 million and free cash flow of $63.4 million, EBITDA of $131.8 million, and net earnings of $45.6 million or $.27 per share.

- In particular, the company's Kisladag and Lamaque mines produced excellent results in Q2; Kisladag contributed 59,890ozAu at $631/oz AISC, while Lamaque added 33,095ozAu at $796/oz AISC.

It was a breakout quarter for Eldorado Gold due to improvements in its

If you want more gold mining stock analysis, subscribe now to The Gold Bull Portfolio. I help my subscribers find the best money-making opportunities in the gold & silver sector.

Receive frequent updates on gold mining stocks, access to all of my top gold and silver stock picks and my real-life gold portfolio, a miner rating spreadsheet with buy/hold/sell ratings on 120+ miners.

I'm currently offering a 2-week free trial, and a 37% discount on annual subscriptions vs. monthly, with a 30-day money back guarantee!