Introduction

Kimberly-Clark (NASDAQ:KMB) is one of the world’s largest producers of personal care and hygiene products. Everyone with kids will know the Huggies brand while the company also produces everyday essentials like Kleenex and toilet paper. Kimberly-Clark is active all over the world but still generates about half of its revenue in North America.

The first half of the year was excellent for Kimberly-Clark

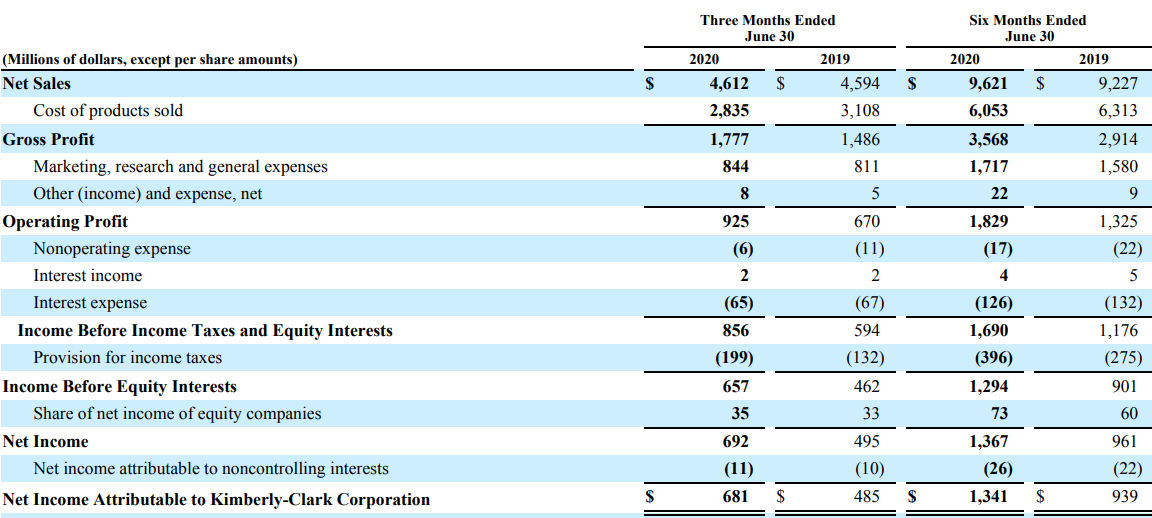

Kimberly-Clark performed well in the second quarter as the company was able to record a 0.2% revenue increase, right on the back of a revenue increase of almost 10% in the first quarter of the year. Meanwhile, thanks to an excellent cost management program ($175M) and a commodity benefit ($80M due to lower pulp prices), the operating costs decreased which caused the gross margin to expand as the gross profit increased by about 20% on a relatively stable revenue.

Source: SEC filings

Thanks to this combination of an increasing revenue and lower COGS, while the G&A expenses increased by just a few percent and the interest expenses decreased by about 2%, the pre-tax income increased by over 40% to $856M while the net income attributable to the shareholders of Kimberly-Clark ended up at $681M which is almost exactly $2.00 per share. Given the $1.93 EPS in the first quarter of the year, the H1 EPS now came in at $3.93, about 40% higher than the $2.73 per share in H1 2019.

That’s great, but I also wanted to make sure the profit boost was backed by a simultaneous increase of the free cash flow result.

Kimberly-Clark reported an operating cash flow of $2.28B but this includes a $490M contribution from changes in the working capital position whereas in H1 2019, the company invested $525M in the working capital position. On an adjusted basis, the operating cash flow in H1 2020 was approximately $1.8B

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!